|

In This Issue...

- From the President

- CSTC Academy

- July Events

- 2020-2021 CSTC Board of Directors

- CSTC Member of the Year

- CSTC Chapter of the Year

- Welcome New CSTC Members

- Legislative Advocacy

- News from the IRS

- Join CSTC!

CSTC Member Benefits

CSTC members have access to benefits such as free payroll processing services for your tax practice, and the opportunity to earn new revenue through their flexible partnership options.

CSTC is pleased to include the VeriFyle ProTM premium secure online document and message sharing service at no cost to CSTC members!

Wolters Kluwer: Discounts on Tax, Accounting & Audit Resources, Software, Information & Services.

CSTC members receive the TaxBook WebLibrary at a special price

Other Member Benefits Include:

$ Savings on all Society Educational Events

$ Savings on Contact, Correspondence & Self Study Education

$ Savings with member specialty CSTC Connects (previouslyYellow Pages) list

$ Savings with E & O Insurance, plus specialty coverage relevant to your profession

$ Online CSTC Find-a-Tax Consultant search to help promote your business!

$ CSTC Member Listserv

Office Depot has partnered with us to provide exclusive savings in-store and online, plus fantastic additional benefits. This program is all about providing preferred pricing to our clubs, and the savings extend to almost every item.

Savings include 20% to 55% off item office supply core list, 20% to 55% off retail on cleaning & break room items, 10% off branded; 20% off private brand ink & toner core list, Average 10% off retail on 200 technology core items, Free next-day shipping on orders of $50 or more, and SIGNIFICANT savings on copy & print. Become a CSTC member to sign up for our Office Depot Small Business Savings Program, administered by Excelerate America.

We are a professional full-service tax advisory firm in San Diego. Our goal is to provide a level of service for our clients that will exceed expectations in every possible way. We strive to offer a diverse level of services to meet the needs of the diverse community we have been working in for more than 30 years.

TaxMama's® EA Exam Course prepares tax professionals to do so much more than just pass the IRS' Special Enrollment Examination. This is an in-depth course that teaches tax law from the ground up. It explains how tax returns work, with examples of basic 1040s, Schedule Cs, 1065s, 1120s, and 1120Ss; you learn tax law, tax research, client representation for audits, appeals and collections.

If you are interested in buying or selling a practice, contact us today! ATB is operated by Enrolled Agents ensuring a complete understanding of our profession. Please give us a call at (855) 428-2225 or visit us online at www.ATBCAL.com for more information and to view our current listings.

CA DRE 02002824

CSTC Mission

CSTC advances professionalism within the tax industry by:

- Providing quality education

- Creating networking opportunities

- Advocating professional standards

|

From the President

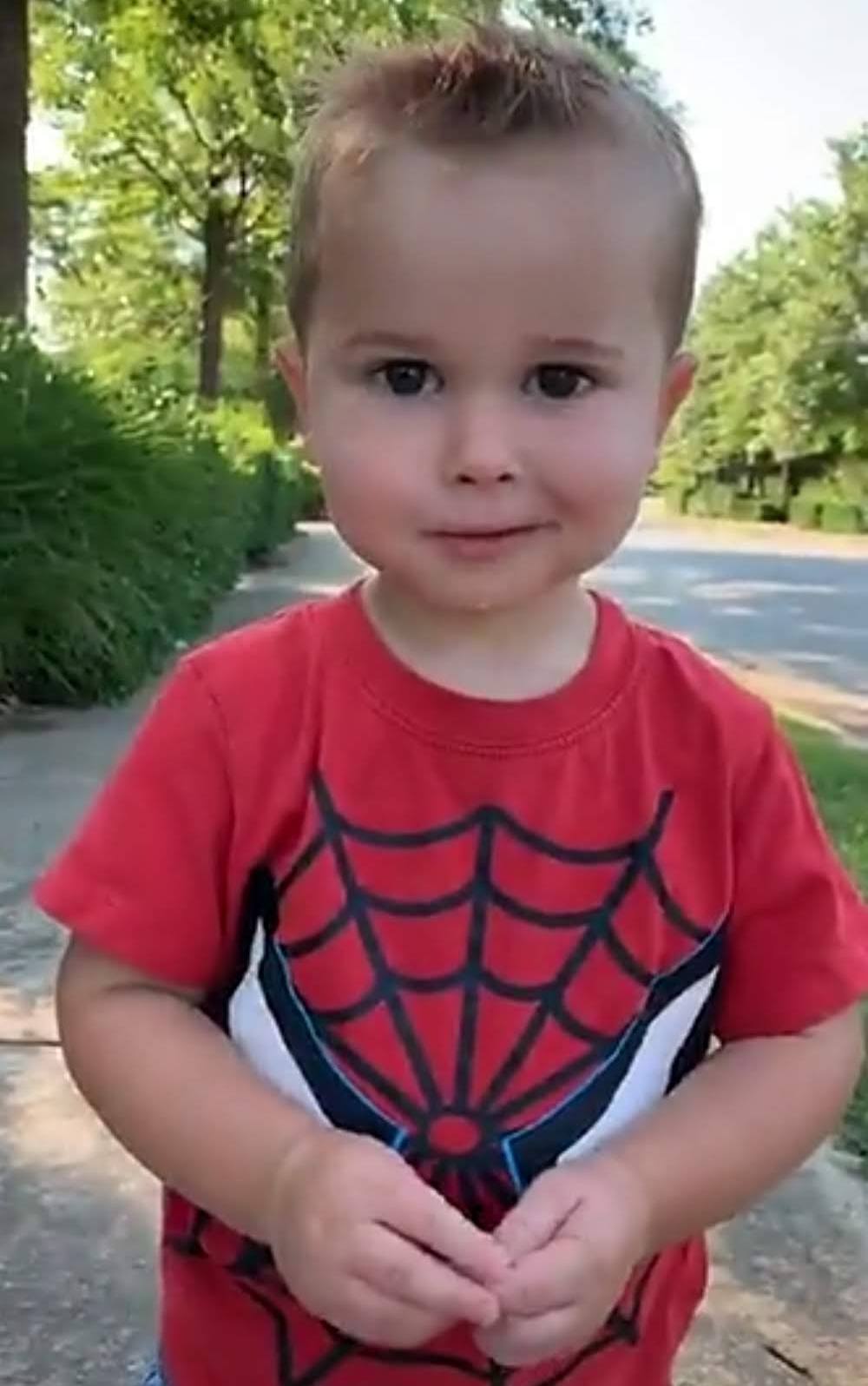

Seth’s New Gloves

A two-year-old is never sure what he wants for his birthday. Whatever he gets is just what he wanted because that is what mom and dad decided. This  month my grandson Seth celebrated his second birthday and I gave him a few things to encourage him to continue pursuing his love of riding his bike off-road with his daddy and his 5-year-old sister. I gave him a new red helmet and some very cool padded bike gloves. You can see by this picture that he loves the gloves. They are very cool. They have bright colors, they fit well, and they make him look like daddy when he rides his mountain bike. He could not wait for daddy to take him to the trails to test them out. For a two-year-old, he does really well on month my grandson Seth celebrated his second birthday and I gave him a few things to encourage him to continue pursuing his love of riding his bike off-road with his daddy and his 5-year-old sister. I gave him a new red helmet and some very cool padded bike gloves. You can see by this picture that he loves the gloves. They are very cool. They have bright colors, they fit well, and they make him look like daddy when he rides his mountain bike. He could not wait for daddy to take him to the trails to test them out. For a two-year-old, he does really well on his pedal-less Stryder bike. his pedal-less Stryder bike.

Almost all of us love new tools. With their nice look and feel, we get excited to test them out or to use them to complete the task we bought them for. When we try out the new tool, we don’t even care if it is not perfect, because it’s new and exciting.

Why do we get new tools? Perhaps we get new tools (like gloves) because we have planned on completing a task and our research shows that the new tool will make the job easier or give us better results. Perhaps we get a new tool to help us complete a task that would otherwise have been very difficult or impossible. Perhaps someone gives us a tool that we did not know we needed until it was given to us.

Take Seth’s new gloves, for example. He didn’t want them before he got them on his birthday. He probably did not even know that he could have gloves. He certainly wasn’t afraid to ride his bike without them. Even though he has gloves and loves them, he still does not know what good they will do. However, his parents know that his little palms will be protected the next time he falls and that they won’t be patching him up so often. Eventually, Seth won’t want to ride without gloves and he will learn all they can do to keep him safe.

CSTC is a premier provider of continuing education and we have done business in a very similar way for 50 years. We have made many adjustments, large and small, as new tools (opportunities) have presented themselves, but the biggest change came when our management team retired and we had to find a professional management organization to run things in a very different way. The change has been huge and difficult. It has required hundreds of hours of work over several years to transition from having our own in-house management team to using a professional management company. Thanks to all the hard work, today, together with our fantastic board of directors, professional management company, and Executive Director, we are doing awesome!

Our newest tool, Zoom, was recently “given” to us and we did not even know that we needed it. Zoom is not new. It has been around since 2011, but most of us did not know that it existed or what it was good for. Today, most everyone in CSTC knows about Zoom. Thankfully, this new tool was there when we needed it. It is not perfect because Zoom cannot give us the in-person contact that CSTC is known for, but it can get us together in ways that we previously thought were very difficult or impossible.

Zoom meetings and webinars are still pretty new and exciting. We are getting better at providing education through them and everyone is getting used to them. We are realizing now just how great it has been to have the tool available. Zoom allows us to provide affordable continuing education to more members and guests than ever before. Will it replace our dinner meetings? For now, yes. Can it replace the in-person touch? No way. Does it provide us with the opportunity to provide education where it would have otherwise have been impossible? Thankfully, yes!

Are Seth’s new gloves the last gloves he will ever need? Hardly. He will wear

them out or outgrow them. They will need to be washed, repaired, or replaced. Will Zoom be all we ever need? No way! We will get back to in-person meetings as soon as we can safely do so. Will we outgrow Zoom and stop providing online education? Not likely. But we will have to adjust, train, and improve the process. We have been looking for good ways to provide online webinars for years and with our new tools, we are very successfully providing it. CSTC is getting better every day at “improving the tax industry one professional at a time” and that makes us very happy.

Thank you everyone for all you do to make CSTC great!

Thank you for your love and patience during these unprecedented times.

Your friend,

Gary Quackenbush, CSTC President

CSTC Academy

Welcome to the CSTC Academy. The Academy offers 80 hours of CE through 31 online courses beginning June 9, 2020. All sessions satisfy the continuing education requirements for EAs, OTRPs, CTECs, CPAs, and attorneys. Sessions are offered every Tuesday and Thursday, beginning at 8:30 am Pacific Time.

The CSTC Academy is offering the 2020 Symposium Package in addition to individual sessions. The 2020 Symposium package allows you to register for ALL sessions at under $7 per CE hour. We hope you agree that this is a deal too good to pass up!

We will begin the sessions with a deep dive on COVID-19 tax relief, followed by sessions on net operating losses, representation, QBI, business entities, AB-5, trusts, California tax, SECURE Act, practice management and more!

We encourage you to explore our exceptional lineup of topics and speakers and give CSTC priority access to meeting your continuing education needs for 2020.

Click here to learn more!

| |

Thursday, July 2, 2020

|

| 8:30 AM to 12:00 PM |

Topic: Maximizing QBI

Speaker: Jane Ryder, EA, CPA

Hours: 4 Federal Tax Law Hours |

| |

Tuesday, July 7, 2020

|

| 8:30 AM to 10:10 AM |

Topic: Audit Reconsideration

Speaker: LG Brooks, EA, CTRS

Hours: 2 Federal Tax Law Hours |

| 10:30 AM to 12:10 AM |

Topic: What to Do With an AB Trust That No Longer Makes Sense

Speaker: Frank Acuña, Attorney at Law

Hours: 2 Federal Tax Law Hours |

| |

Thursday, July 9, 2020

|

| 8:30 AM to 10:10 AM |

Topic: Rethink What you Know about Tax, Wealth & Business Exit Planning

Speaker: Edward Cotney, Certified Exit Planner, Certified Philanthropic Developer, Family Wealth Counselor

Hours: 1 Federal Tax Law Hour, 1 California Hour |

| 10:30 AM to 12:10 AM |

Topic: IRA Fundamentals and the Need for IRA Trusts

Speaker: Frank Acuña, Attorney at Law

Hours: 2 Federal Tax Law Hours |

| |

Tuesday, July 14, 2020

|

| |

No sessions in observance of the filing deadline |

| |

Thursday, July 16, 2020

|

8:30 AM to 12:00 PM

|

Topic: IRS Audit Audit & Appeals Representation – Problem Issues of Schedule C

Speaker: Anthony D. Bustos, EA

Hours: 4 Federal Tax Law Hours |

| |

Tuesday, July 21, 2020

|

| 8:30 AM to 10:10 AM |

Topic: Shannon's Hall of Tax Curiosities - Curiouser and Curiouser

Speaker: Shannon Hall, EA

Hours: 2 Federal Tax Law Hours |

| 10:30 AM to 12:10 AM |

Topic: Collection Due Process Tax Matters

Speaker: LG Brooks, EA, CTRS

Hours: 2 Federal Tax Law Hours |

| |

Thursday, July 23, 2020

|

| 8:30 AM to 12:00 PM |

Topic: Appealing Decisions

Speaker: Gary Quackenbush, Esp

Hours: 4 Federal Tax Law Hours |

| |

Tuesday, July 28, 2020

|

| 8:30 AM to 12:00 PM |

Topic: LLC Classifications and Elections

Speaker: Susan Tinel

Hours: 4 Federal Tax Law Hours |

| |

Thursday, July 30, 2020

|

| 8:30 AM to 10:10 AM |

Topic: Filing the Non-Filer

Speaker: Veronica Marelli, EA

Hours: 2 Federal Tax Law Hours |

| 10:30 AM to 12:10 AM |

Topic: Interest Income, Expense & Deductions for Individuals, Investment and Businesses

Speaker: Jane Ryder, EA, CPA

Hours: 2 Federal Tax Law Hours |

| |

Tuesday, August 4, 2020

|

| 8:30 AM to 10:10 AM |

Topic: Intellectual Property

Speaker: Curt Harrington, Attorney at Law

Hours: 2 Federal Tax Law Hours |

| 10:30 AM to 12:10 AM |

Topic: Understanding Criminal Prosecution of Tax Crimes

Speaker: Michael Blue, Attorney at Law

Hours: 1 Federal Tax Law Hour, 1 Ethics Hour |

| |

Thursday, August 6, 2020

|

| 8:30 AM to 10:10 AM |

Topic: Reading Between the Lines - How to Identify What Your Client Hasn't Told You

Speaker: Eva Rosenberg, MBA, EA

Hours: 2 Federal Tax Law Hours |

| 10:30 AM to 12:10 AM |

Topic: Tax Professional Issues - ETHICS

Speaker: Gary Quackenbush, Esq

Hours: 2 Ethics Hours |

| |

Tuesday, August 11, 2020

|

| 8:30 AM to 12:00 PM |

Topic: Dear Younger Me - (Series - Sch A, Sch C, Sch E)

Speaker: Claudia Stanley, CPA, EA

Hours: 4 Federal Tax Law Hours |

| |

Thursday, August 13, 2020

|

| 8:30 AM to 12:00 PM |

Topic: Discovering the Life Cycle of a Non-profit Organization

Speaker: David Eastis, CRTP

Hours: 2 Federal Tax Law Hours, 2 California Hours |

| |

Tuesday, August 18, 2020

|

| 8:30 AM to 12:00 PM |

Topic: Business Entity Balance Sheets & Basis

Speaker: Jane Ryder, EA, CPA

Hours: 4 Federal Tax Law Hours |

Click here to learn more and register!

July Virtual Chapter Events

July 1, 2020

Topic: Bankruptcy Secrets!

Temecula Valley Chapter Virtual Meeting

2 Federal Tax Law Hours (Topics covering existing tax law)

July 16, 2020

Topic: Disclosure of Foreign Assets 2020 and Beyond

San Diego-North County Chapter Virtual Meeting

2 Federal Tax Law Hours (Topics covering existing tax law)

July 22, 2020

Topic: California Tax Update

San Jose Chapter Virtual Meeting

2 California hours (Topics covering California law issues)

Click here to view the CSTC calendar.

Congratulations to the 2020-2021

CSTC Board of Directors!

| Position |

Name |

Chapter |

| President |

Gary Quackenbush |

San Diego Chapter |

| 1st Vice President |

Linda Dong |

Wine Country Chapter |

| 2nd Vice President |

Jen Horton |

Greater Long Beach Chapter |

| Secretary |

Shari Hardy |

Inland Empire Chapter |

| Treasurer |

Claudia Stanley |

Central Valley Chapter |

| Region One Director |

Karen DeVaney |

Central Valley Chapter |

| Region Two Director |

Shannon Hall |

Greater Long Beach Chapter |

| Region Two Director |

David Knutson |

Inland Empire Chapter |

| Region Three Director |

David Eastis |

Orange County Chapter |

| Region Three Director |

Guy Liford |

Orange County South Chapter |

| Region Four Director |

Heather Santineau |

San Diego Chapter |

| Region Four Director |

Justin Price |

East County San Diego Chapter |

| Parlimentarian |

Ruth Godfrey |

Inland Empire Chapter |

| Immediate Past President |

Rod Couts |

North County San Diego Chapter |

Member of the Year

At the heart of CSTC are those individuals who give so freely of their time to further the CSTC mission. The Member of the Year Award is CSTC’s highest honor, and acknowledges an outstanding individual for their extraordinary efforts in helping their fellow tax professionals by supporting CSTC. Individuals are nominated by other CSTC members, and a panel of judges then selects the final recipient. At the heart of CSTC are those individuals who give so freely of their time to further the CSTC mission. The Member of the Year Award is CSTC’s highest honor, and acknowledges an outstanding individual for their extraordinary efforts in helping their fellow tax professionals by supporting CSTC. Individuals are nominated by other CSTC members, and a panel of judges then selects the final recipient.

This years recipient of the Member of the Year award is Linda Dong, EA.

Linda has been transformative to the industry and CSTC throughout a very distinguished career as a tax professional.

Linda first got her feet wet in taxation by joining the IRS right out of college but felt a strong desire to work with clients instead of auditing them. She would go on to create a very successful tax and accounting practice.

An Enrolled Agent (EA) since 1982, Linda also possesses numerous other credentials including Accredited Business Accountant (ABA) and Accredited Tax Advisor (ATA), is a QuickBooks ProAdvisor and frequently teaches classes in accounting and tax to other professionals.

The first mark Linda made on CSTC was to bring together another organized group of tax professionals to become members of CSTC. It was a big move for CSTC, and one that continues to benefit our organization today.

When CSTC needed to alter the fall education offerings, it was Linda who took the challenge by the horns to create the Fall Tax and Accounting Forum, with the goal to broaden the reach of CSTC’s educational outreach.

With the 2020 Summer Symposium neatly packaged and ready to go, COVID-19 reared its ugly head, jeopardizing CSTC’s ability to hold its most important event. Linda guided CSTC in quickly moving the Summer Symposium to a completely online event in just over two weeks. Months of planning turned upside down and righted phenomenally quickly, ensuring that CSTC was able to accomplish its educational mission despite the ongoing crisis.

Linda is the First Vice President of CSTC, in charge of CSTC’s educational offerings, something she is very passionate about. She is also the Secretary-Treasurer of the CSTC’s Wine Country Chapter and its past president.

Congratulations, Linda!

CSTC Chapters of the Year

Every year CSTC congratulates the CSTC Chapters who have recruited the most members during the previous year.

In third place with 14 new members is the San Jose Chapter. The President of San Jose is Bob Searle. Thank you to the San Jose Chapter Leaders!

In second place with 15 new members is the Greater Long Beach Chapter. The President of the GLB Chapter is Nikki Lebrun. Thank you to the Greater Long Beach Chapter Leaders!

This year there was a tie for the Chapter with the most recruited members. With 17 new members, the top two Chapters with the most recruited members are the Inland Empire and San Francisco Bay Chapter!

The President of the IE Chapter is Hilde Morrow and the President of the San Francisco Bay Chapter is Morris Miyabara.

Thank you to all the Chapter Leaders for working so hard during the year to recruit new members. There was not a single CSTC Chapter that did not gain a new member. Congratulations to all of CSTC.

Welcome New CSTC Members!

Please help us in joining our newest CSTC Members!

Patricia Anderson

Greater Long Beach Chapter

Linda Beeson

Sacramento Chapter

Nalin Bhatt

Wine Country Chapter

Charles Chongo

San Francisco Bay Chapter

Peter Cullen

Orange County Chapter

Agnes Michetti

San Diego Chapter

Jack Miller

San Diego East County Chapter

Vijay Pendse

San Jose Chapter

Legislative Advocacy

CSTC has been the leading Association in supporting legislation to provide protection for our profession, to support our profession, and to enhance our profession. CSTC continuously leads our industry through legislative advocacy, educational opportunities, and professional inclusion.

CSTC works closely with a Legislative Consultant to keep an eye on important bills that would affect taxpayers and small business owners.

Please click here to view the bills that CSTC is currently monitoring.

Join the California Society of Tax Consultants!

Click here to fill out an online application.

CSTC advances professionalism within the tax industry by:

- Providing quality education

- Creating networking opportunities

- Advocating professional standards

|