|

Member of the Year Recipients

About the Member of the Year Award: At the heart of CSTC are those individuals who give so freely of their time to further the CSTC mission. The Member of the Year Award is CSTC’s highest honor, and acknowledges an outstanding individual for their extraordinary efforts in helping their fellow tax professionals by supporting CSTC. Individuals are nominated by other CSTC members, and a panel of judges then selects the final recipient. The Member of the Year Award is presented at the CSTC Annual Meeting, and the recipient receives an Award and their name will be added to a permanent plaque at the Society offices.

|

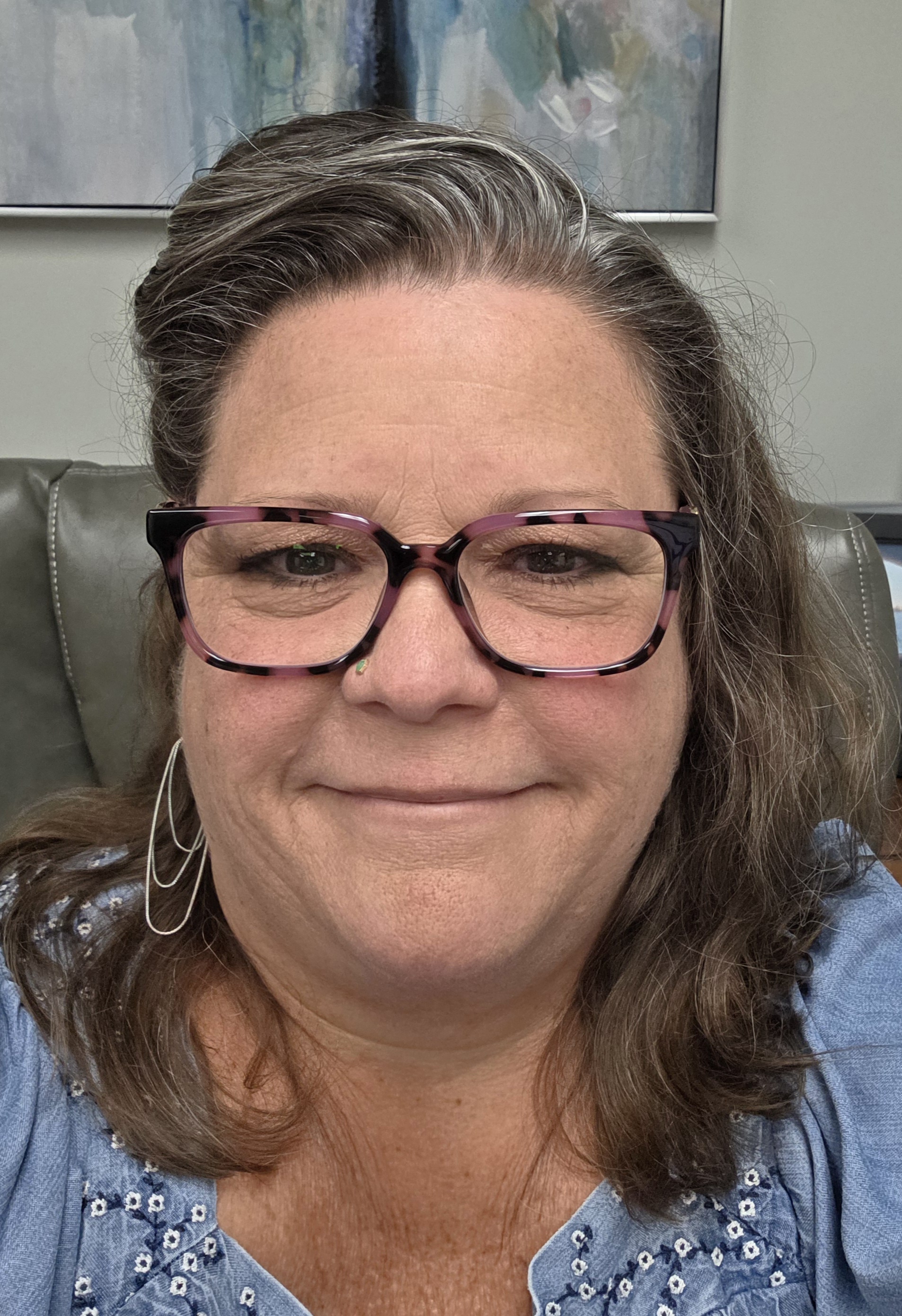

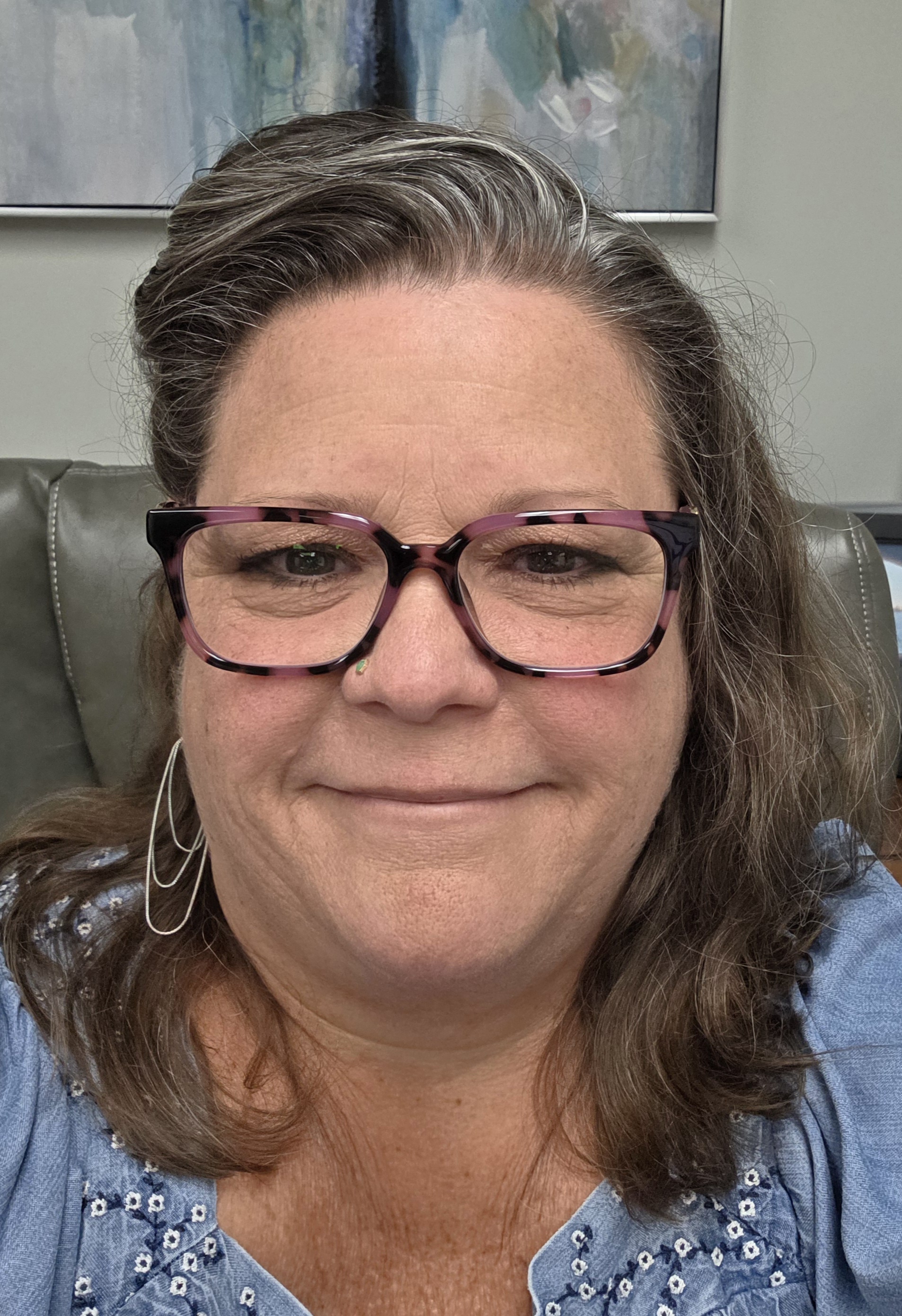

Heather Santineau - 2025 Recipient Heather Santineau - 2025 Recipient

Being selected as member of the year is a great honor, a humbling experience and a powerful recognition of service, leadership, and intuitive insights that makes CSTC successful.

Our member of the year has expressed loyal and active involvement in CSTC for many years.

Our member of the year speaks into various situations, at times identifying the elephant in the room, and unashamedly declares “the emperor has no clothes”.

We need this type of straight forward insight and leadership, sprinkled with a warm sense of humor.

Our member of the year displays energetic diligence attending every Society Board meeting and follows through in tasks,

Our member of the year hails from the San Diego Chapter.

She has served as chapter president, vice president and secretary.

She frequently offers help and support to others,

She takes initiative acting as region 4 Director and helped to define the role.

In fact, she has made her board meeting summaries available to all regional directors.

She is currently serving as 2nd VP for CSTC.

She participates and is active in every discussion with thoughtful and reasoned comments.

I do not know if she is a fan of the San Diego Padres, but I know that CSTC is a fan of our 2025 Member of the Year: Heather Santineau!

|

|

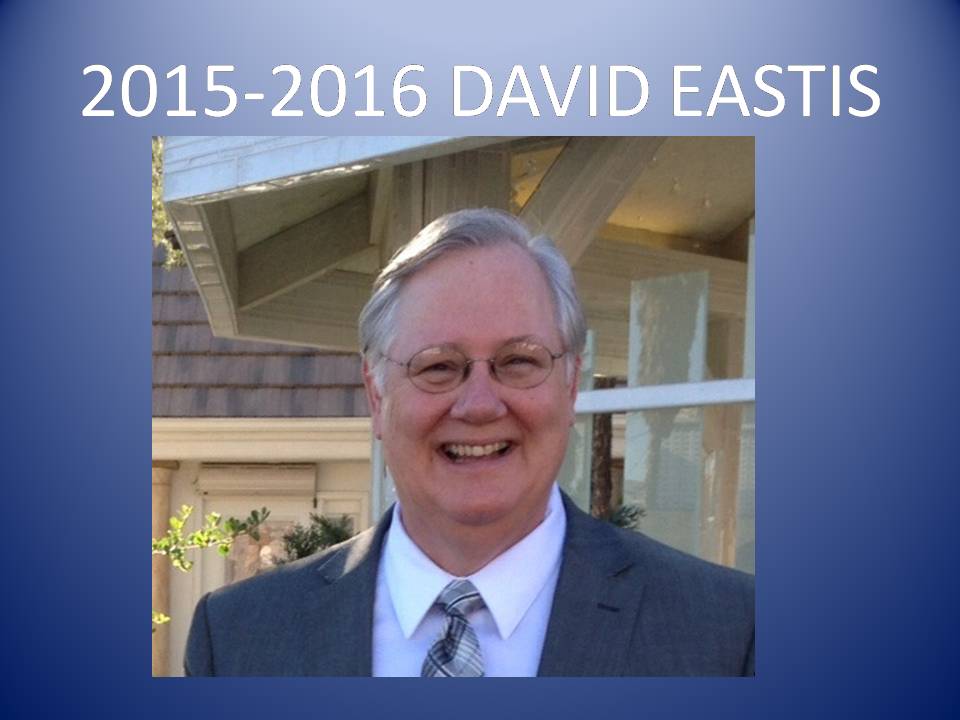

David Eastis - 2024 Recipient David Eastis - 2024 Recipient

There are some rare people that you will encounter in your life that will leave a lasting impact whether you know them for five minutes or fifty years, and this year’s Member of the Year is one of those people.

The joy they feel in sharing their knowledge and expertise makes them a tremendous speaker, and an amazing colleague. They always seem to have time to help out with tough questions about their areas of expertise, which are many.

This member not only dedicates much of their time to CSTC, but is an active member of their community, serving on national boards to many other organizations.

CSTC has been honored to have this active member since 2004, and during that time they have held offices from Secretary to Regional Director to President, serving at both the chapter and society level. They brought their passion for parliamentary procedure (yes, you heard that right) to the board, leading the effort to transition us into the Carver’s Policy of Governance. They were also instrumental in the search for and the implementation of our management team.

This person is always there to offer encouragement, a hug, and even sometimes a conspiratorial wink. This year’s member of the year award goes to David Eastis.

|

|

Shannon Hall - 2023 Recipient Shannon Hall - 2023 Recipient

Shannon Hall has been working in the tax industry for over a decade, though her interest in taxes truly began when, as a child, she would play with the tax forms at the library. She studied classical theatre at a conservatory in Los Angeles, so it was really just a matter of time before she joined the tax business. Throughout her career Shannon has prepared taxes from her kitchen table to H&R Block, where she was an office manager and instructor, before finally settling into a fabulous office in Long Beach, CA. She has been making her way across California and Nevada speaking at both local chapters of several tax organizations as well as statewide conferences. You can catch her this year with Brass Tax for the EA Bootcamp. More than anything Shannon strives to make tax education fun and engaging.

|

|

Claudia Stanley - 2022 Recipient Claudia Stanley - 2022 Recipient

She is a graduate of California State University, Fresno, and serves as treasurer of the California Society of Tax Consultants, as education chair of the Central California Chapter of Enrolled Agents, and as treasurer of Fresno’s local chapter of American Business Women’s Association. She is a long-time member of CSTC. In 2016 she was named member of the year of the Central Valley Chapter of CSTC and in 2001 she was named one of the Top Ten Women of the Year in the nation by the American Business Women’s Association. She frequently speaks on various tax topics. She is passionate towards the things she cares about – her family, her profession, her church, and CSTC.

In her free time she enjoys gardening, spending time with her grandpuppies, and balancing the CSTC books.

|

|

Gary Quackenbush - 2021 Recipient Gary Quackenbush - 2021 Recipient

Gary Quackenbush and his team operate a Financial Solutions law practice, GQ LAW, in San Diego, California, and San Juan Capistrano, California. Since 1988 his emphasis has been tax and financial problem solving and implementing solutions for tax problem resolution such as Offers in Compromise, audit reconsideration, appeals, installment agreements, bankruptcy, federal district court actions, federal tax court actions, etc.

His estate planning practice focuses on wills, trusts, and estate administration including probate court work and inheritance litigation. The firm handles contract disputes, property disputes, and business matters. His small business consulting involves the choice of and formation of business entities such as sole proprietorships, partnerships, corporations, and Limited Liability Companies.

Gary received his Bachelor of Science degree in business finance from Brigham Young University in 1984. He received his Juris Doctor degree from California Western School of Law in 1988. He is admitted to practice in all courts in the state of California and in all courts in the state of Colorado, US Bankruptcy Court in the Southern, Central, and Northern Districts of California, Federal District Court in the Southern and Central districts of California, Federal District Court and US bankruptcy court in the District of Colorado, and U.S. Tax Court.

Gary is a regular guest lecturer to tax professionals, attorneys, and volunteer organizations. He is the host of his own podcast “GQ on the Law” available on iTunes, Podbean, and Google Podcasts. Since 2010 he has been guest and co-host on the “Word on Wealth” radio program with MartySchneider on KCBQ 1170 AM and KPRZ 1210 AM. He has been a guest on UTTV “TheAmerican Dream” and the “Taylor Baldwin Show” and has appeared on NBC, ABC, CBS, and KNSD TV.

He is Past-President of the California Society of Tax Consultants, San Diego Chapter, and currently is President of CSTC at the state level.

Gary and his wife Cheryl’s growing family consists of four children, their spouses, and twelve grandchildren. Outside of the office, you will find Gary spending time with Cheryl and their family, traveling, water skiing, boating, rock climbing, mountain biking, hiking, and camping.

|

|

Linda Dong - 2020 Recipient

Linda Dong graduated with honors from the University of Illinois in Chicago with a degree in Accounting. She went to work for the IRS, where she received very thorough training in taxes and began auditing corporations. Not liking the adversarial relationship inherent in tax audits, Linda left the IRS and started a tax and accounting practice from her home. She grew her practice to include four employees, but eventually downsized and is now once again a sole practitioner working out of her home office. She provides tax and accounting services to individuals, small businesses, and nonprofit organizations.

Linda has been an Enrolled Agent (EA) since 1982. Her credentials from the Accreditation Council of Accountancy and Taxation include Accredited Business Accountant (ABA) and Accredited Tax Advisor (ATA). She is a QuickBooks ProAdvisor and frequently teaches classes in accounting and tax to other professionals. A member of several tax and accounting professional groups, she is currently serving as First Vice President of the California Society of Tax Consultants and Secretary-Treasurer of the Wine Country Chapter

|

|

Ingrid Chamberlin - 2018 Recipient

Ingrid has devoted her time and resources over the past 8 years to develop a successful membership marketing plan for the North County San Diego Chapter and has also given encouragement and ideas to Society for the advancement of membership. She has devoted many hours participating not only at the Chapter level, but also in attending the Society Board meetings as well. As an enthusiastic member who believes in the mission Society promotes, she has diligently served on committees promoting the advancement of Society. Ingrid joined CSTC on 2009, served as the North County San Diego 1st Vice President (Membership Chair) from 2011-2018 and is the current North County San Diego Chapter President.

She sets lofty goals, has a humor drier than the Sahara desert , gets the job done, and cares about the advancement of the tax profession. Her support of the organization has been unwavering. She has been instrumental in developing the changes needed to move our organization's future forward and has embraced the visions of taking Society forward into the next millennium.

|

|

Priscilla Lerma - 2017 Recipient Priscilla Lerma - 2017 Recipient

Priscilla Lerma joined the San Bernardino Chapter of ISTC (Inland Society of Tax Consultants) in June 1992. The organization was later renamed CSTC (California Society of Tax Consultants) and the Chapter was renamed to Inland Empire Chapter. She become an Enrolled Agent in 1986 and worked part time for 21 years at H&R Block, Chino office and then went to work for Teders Business & Tax Service, Inc. in Ontario in October 2002 and is celebrating her 15th year with this firm this year. She does returns for Individuals, Estates and Trusts, some LLCs and specializes in Real Estate questions and mortgages. She also had a Real Estate license for 22 years.

Priscilla served as President in 2011 and 2012. She also served as Membership Director, Secretary and Greeter for the Inland Empire Chapter, and on the Public Relations Committee and Membership Committee at the Society Level. She has been a Notary Public since 1981. She is also a member of NSA (National Society of Accountants) and has appeared in the 1981-82 Twelfth Edition of Who’s Who of American Women.

Priscilla has also attended just about all of the CSTC Summer Symposiums, along with several of the IRS Stakeholder Liaison meetings, as well as the Long Beach, San Gabriel Valley and North County San Diego CSTC meetings. She also encouraged several of the High Desert Chapter members to join the Inland Empire Chapter when their chapter was disbanded.

Priscilla was born in Canada, but is now a naturalized citizen. She has two sons and 3 grandsons and loves to travel. She recently became a volunteer for Travelers Aid of Inland Empire at the Ontario International Airport.

|

|

Shirley Greta Ward - 2016 Recipient Shirley Greta Ward - 2016 Recipient

Known to CSTC members as Greta, she joined CSTC on May 1, 1989 and has been actively involved, loyal and dedicated ever since.No matter what adversity or fear she may have been challenged with, Greta is always very positive and optimistic, all the while maintaining a great sense of humor.

She was President of San Diego Chapter in 2011 & 2012 and President of East County Chapter in 2016 & again in 2017. First Vice President of the Society in 2013 and Society 2nd Vice President in 2014.

The creator of the Autumn Classic in Morongo, CA.

|

| 2015 |

Rodney J Couts |

| 2014 |

Augustine Beanez |

| 2013 |

Beanna Whitlock |

| 2012 |

Augustine Beanez |

| 2011 |

Sharon Hardy |

| 2010 |

Michael Mergen |

| 2009 |

George Fakhouri |

| 2008 |

Hilde Morrow |

| 2007 |

Bud Garrett |

| 2006 |

Linda Beckett |

| 2005 |

Richard Malzahn |

| 2004 |

Thomas Carter |

| 2003 |

Virginia Bates |

| 2002 |

Nicole LeBrun |

| 2001 |

Kathy Nakagawa |

| 2000 |

Linda Morlang |

| 1999 |

Sharyn Jones |

| 1998 |

Ruth Godfrey |

| 1997 |

Mary Ann Teders |

| 1996 |

Bob Carlitz |

| 1995 |

Arthur Purdy |

| 1994 |

Sylvia Lang |

| 1993 |

Betty Stenger |

| 1992 |

Wally McIllroy |

| 1991 |

Alice Moriarty |

| 1990 |

Betty Garrett |

| 1989 |

David Gorsich |

| 1988 |

Lila Gary |

| 1987 |

Karen De Vaney |

| 1986 |

Agnes Michetti |

| 1985 |

Tom Hess |

| 1984 |

Sanford Rosenthal |

| 1984 |

Marlene Fawcett |

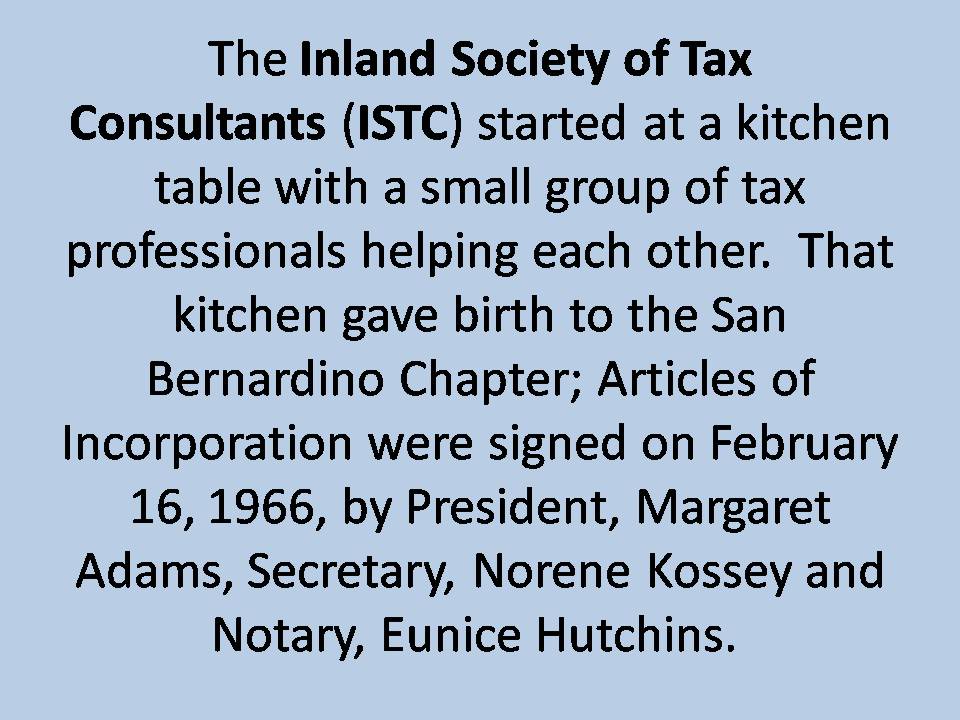

CSTC celebrates 50 years of quality education to tax consultants. 1966-2016

|

David Eastis - 2024 Recipient

David Eastis - 2024 Recipient Shannon Hall - 2023 Recipient

Shannon Hall - 2023 Recipient Claudia Stanley - 2022 Recipient

Claudia Stanley - 2022 Recipient

Shirley Greta Ward - 2016 Recipient

Shirley Greta Ward - 2016 Recipient