|

In This Issue...

- From the President

- 2020 Summer Symposium Update

- COVID-19 Resources

- April Events

- CSTC Listserv - A Member Resource

- VeriFyle - A Member Resource

- Welcome New CSTC Members

- Legislative Advocacy

- News from the IRS

- Join CSTC!

CSTC Member Benefits

CSTC members have access to benefits such as free payroll processing services for your tax practice, and the opportunity to earn new revenue through their flexible partnership options.

CSTC is pleased to include the VeriFyle ProTM premium secure online document and message sharing service at no cost to CSTC members!

Wolters Kluwer: Discounts on Tax, Accounting & Audit Resources, Software, Information & Services.

CSTC members receive the TaxBook WebLibrary at a special price

Other Member Benefits Include:

$ Savings on all Society Educational Events

$ Savings on Contact, Correspondence & Self Study Education

$ Savings with member specialty CSTC Connects (previouslyYellow Pages) list

$ Savings with E & O Insurance, plus specialty coverage relevant to your profession

$ Online CSTC Find-a-Tax Consultant search to help promote your business!

$ CSTC Member Listserv

Office Depot has partnered with us to provide exclusive savings in-store and online, plus fantastic additional benefits. This program is all about providing preferred pricing to our clubs, and the savings extend to almost every item.

Savings include 20% to 55% off item office supply core list, 20% to 55% off retail on cleaning & break room items, 10% off branded; 20% off private brand ink & toner core list, Average 10% off retail on 200 technology core items, Free next-day shipping on orders of $50 or more, and SIGNIFICANT savings on copy & print. Become a CSTC member to sign up for our Office Depot Small Business Savings Program, administered by Excelerate America.

We are a professional full-service tax advisory firm in San Diego. Our goal is to provide a level of service for our clients that will exceed expectations in every possible way. We strive to offer a diverse level of services to meet the needs of the diverse community we have been working in for more than 30 years.

TaxMama's® EA Exam Course prepares tax professionals to do so much more than just pass the IRS' Special Enrollment Examination. This is an in-depth course that teaches tax law from the ground up. It explains how tax returns work, with examples of basic 1040s, Schedule Cs, 1065s, 1120s, and 1120Ss; you learn tax law, tax research, client representation for audits, appeals and collections.

If you are interested in buying or selling a practice, contact us today! ATB is operated by Enrolled Agents ensuring a complete understanding of our profession. Please give us a call at (855) 428-2225 or visit us online at www.ATBCAL.com for more information and to view our current listings.

CA DRE 02002824

CSTC Mission

CSTC advances professionalism within the tax industry by:

- Providing quality education

- Creating networking opportunities

- Advocating professional standards

|

From the President

GRIEF AND NEW FOUND OPPORTUNITIES

Does this feel like we are living a combination of 9/11 and the 2008 financial crisis at the same time? Most of what’s happening in our world right now is new to all of us.

While on a video call with my son and his family and then with my daughter and her family we were discussing how everyone was feeling. How are the kids? What is “homeschooling” like? How is the job? How are you? You know, the usual questions we like to ask. The responses from both families were similar. They were feeling like it is kind of unreal, foggy, confusing, and unsettling. Some words they used to describe the conditions were crazy, wild, and chaotic. To describe what their new life is like they described working from home, homeschooling, home pre-schooling, home middle-schooling, home recess period, family crafts, family exercise, family yoga, TV time, video games, and on and on. The world has changed and we are not sure how to feel about it.

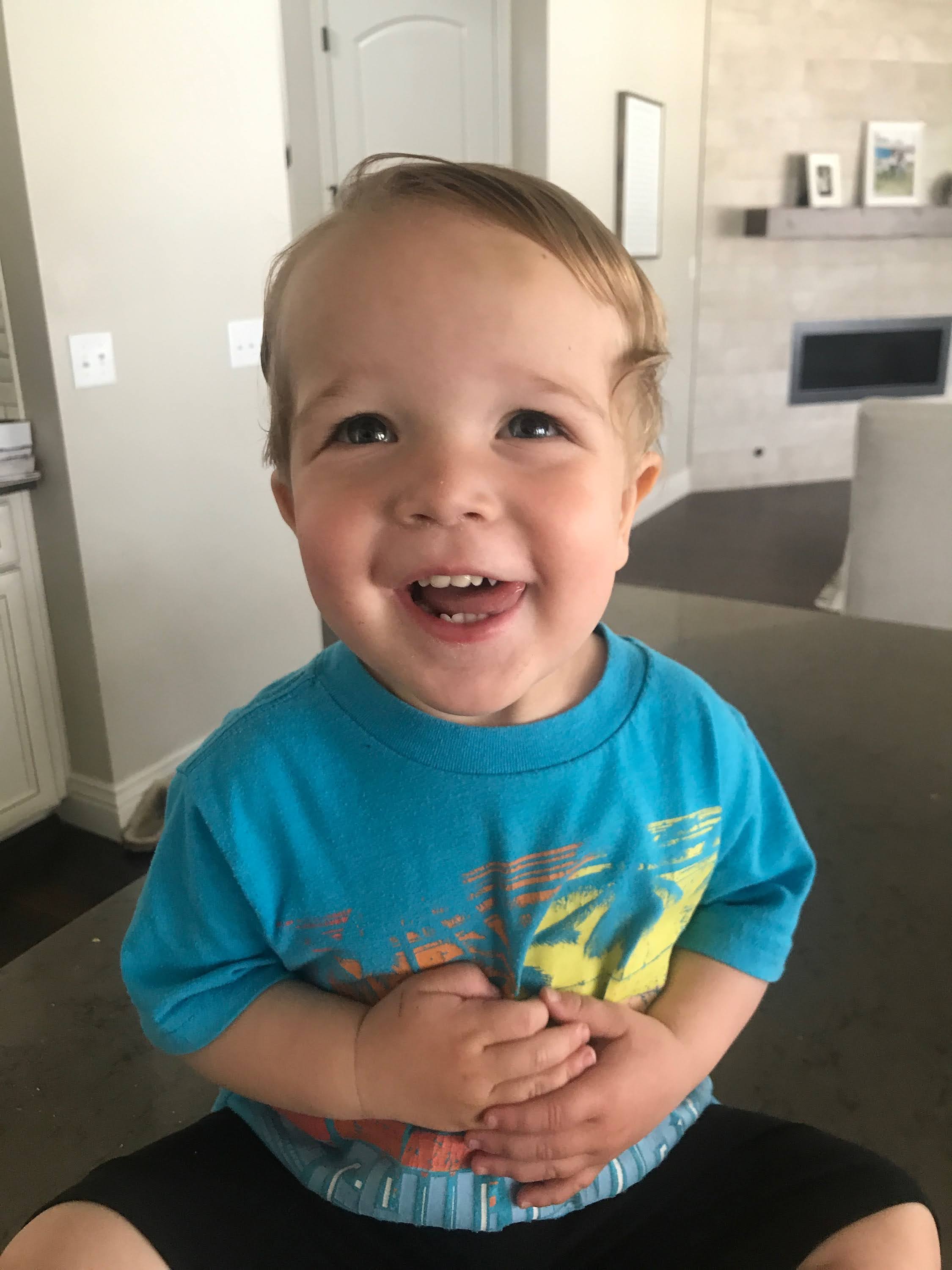

My youngest son added to his “new life” list, a new baby boy, Logan. The picture here is Logan’s big brother, Scott, ready to go home to meet his new baby brother. My youngest son added to his “new life” list, a new baby boy, Logan. The picture here is Logan’s big brother, Scott, ready to go home to meet his new baby brother.

SO, WHAT ARE WE ALL FEELING AND WHAT CAN WE DO ABOUT IT?

According to David Kessler, a foremost expert on grief and founder of www.grief.com, we are feeling grief. To figure out what to do about it, we need to understand the stages of grief. The following is a brief summary of the stages and not an in-depth discussion. I recommend reading some of his materials for more details.

The stages are not linear and can happen in a different order than listed here.

Denial – this virus won’t affect us.

Anger – you’re making me stay home and taking away my activities.

Bargainin – Okay, if I keep my social distance for two weeks, everything will be better, right?

Sadness – I don’t know when this will end.

Acceptance – This is happening; I have to figure out how to proceed. Acceptance is where power lies. Acceptance gives us control – I can wash my hands. I can keep a safe distance. I can learn how to work virtually.

Anticipating the day when everything will return to normal seems more of a dream than a reality. Isn’t it wild to think that just 4 weeks ago we were speeding toward the April 15, 2020, deadline and feeling the crush of time to get everything done. Now, look where we are. Returns are not due until July 15, we are told to work from home, we need to lay off support staff, stay inside, and keep our social distance. How fast things changed. How fast things were turned upside down for many people. How unsettling.

We are all over the place in the stages of grief. We are all struggling to make heads or tails of it all, but in the end, what helps me the most is to know that we are not alone! We are ALL affected by it and we will ALL get through it together.

WHAT CAN WE DO ABOUT IT?

Wouldn’t it be great if we accepted the fact that we are all on the same team because we are! There are plenty of people that will look at you crossly or hold their breath while they walk past you. There are those who will scorn you for walking too close to your walking buddy. But, there are so many more who will respond to a smile, a wave, or a greeting. My wife Cheryl and I were driving through our neighborhood Sunday and a couple sitting on their front lawn waved vigorously as we drove by, it was awesome! What did I do? I waved back and smiled. It felt great! After that, I decided to cheer up and do the same. I am learning how to do effective video meetings and I love it. My clients love them too! It is different than face-to-face, but, you know, that’s the world we live in right now and it’s wonderful we have the technology to help out.

I believe that as we accept the reality of our situation and do our part to prevent the spread of COVID-19, we can be nice to people and say hi. We can acknowledge that we are going through the same thing as everybody else. We can serve each other in new and exciting ways. We can make that phone call or write that note we have been avoiding. We can learn to do video calls and conferences. We can take advantage of this time to learn new technology to communicate with others and really enjoy it.

We can find joy in the journey.

Be kind to others. It works!

Your friend and servant,

Gary Quackenbush

CSTC President

2020 Summer Symposium Update

The California Society of Tax Consultants has been closely monitoring the rapidly changing COVID-19 epidemic. The health and safety of our members, and the populations they serve, is our highest priority. Recent developments, including increased travel restrictions and limits on mass gatherings, have prompted CSTC’s Board of Directors’ to cancel the 2020 Summer Symposium in Reno and consider moving it to an online event.

The Symposium Committee is currently investigating platforms to deliver the educational content of the Symposium online in a live webinar format. They are also working on a schedule to allow attendees to attend all the sessions that were going to be offered at the 2020 Symposium. Please bear with us while we work out the details to offer you the best virtual live event.

Please take a moment to read our frequently asked questions below for more details on the 2020 Summer Symposium:

Frequently Asked Questions:

I already registered but now I do not want to attend. Will CSTC refund registration fees for the 2020 Summer Symposium?

If you are already registered and are not interested in the online virtual event, please email [email protected] to cancel your 2020 Symposium registration. CSTC will issue penalty-free refunds for all-conference registration-related fees, including registration and optional add-ons such as the purchase of handouts, additional dinner tickets, etc. Please allow up to six weeks for refunds to be processed. Payments processed via credit card will be refunded automatically to your account. You will be notified electronically once refunds have been processed.

I already registered and am interested in attending the online Summer Symposium. Do I need to do anything?

No! Because you have already registered, you will automatically be included in the virtual Symposium attendee count.

What about my hotel reservation?

Please contact the Silver Legacy Resort and Casino at 1-800-687-8733 to cancel your reservation. Please click here to view the Silver Legacy’s COVID-19 update page.

What about air travel?

Please check with your air carrier for flight cancelation policies.

Where will the 2021 Symposium be located?

The 2021 Summer Symposium will be held at the Silver Legacy Resort and Casino in Reno, Nevada on June 6-9, 2021. CSTC will return to Las Vegas in 2022.

What about the 2020 CSTC Annual Business Meeting?

The Board of Directors is looking into options to hold the Annual Business Meeting online. We will keep you posted when we have an update.

Thank you for your understanding and patience.

COVID-19 Resources

Please find below links we hope will be helpful during the COVID-19 pandemic:

Business Resources

Information about COVID-19 (Coronavirus)

Please contact the CSTC Office at [email protected] if you have any questions.

April Events

We highly encourage everyone to follow the limited group gathering guidelines set by the CDC and remain home to prevent the spread of the virus. Please contact your Chapter Leader if you have questions about your upcoming Chapter Meetings. We will provide additional information about future chapter meetings as we get closer to May.

CSTC Listserv - A Member Resource

Stuck inside and have a tax question you want to pose to other tax consultants? Use the CSTC Member Listserv!

What is the CSTC Member Listserv?

The CSTC Member Listserv is an email address, which forwards your email message to all subscribing CSTC members.

The CSTC Member Listserv is a great way to communicate quickly and easily with the subscribed members regarding business-related questions and requests for assistance.

How to Subscribe and Who Can Use It

The CSTC Listserv is for the exclusive use of CSTC members.

To gain access to the Listserv for the first time, please click here.

With data security being an increasingly important issue for tax professionals, CSTC is pleased to partner with VeriFyle and offer VeriFlye Pro secure online document and messaging service free to members.

- VeriFyle Pro replaces less secure technologies (like email and cloud sharing services like Dropbox) for the purpose of sharing important or sensitive information.

- The service is easy to use, completely secure and can be customized for the look of your tax preparation practice.

- VeriFyle Pro provides a professional and secure way to present yourself to existing and prospective clients, and it is free to use for all of your invited guests.

VeriFyle has made some important improvements, including:

- More Space—The Verifyle Pro storage limit has doubled! We've gone from 50GB to 100GB with no change in price.

- Session Control—Want us to log you out after an hour of inactivity? How about a day? Or a minute? You get to decide. Visit your Account Settings and click "Session Management" to adjust your window to your liking and to manually log out of any active sessions on other devices.

- Enhanced Digital Signatures—Verifyle Pros can now designate exactly where they want their guests to sign, initial and date a Document.

- Private Messages—You now have one-on-one private messages that you can use to share Documents and Messages without having to create a Workspace. Just click someone's name and start sharing.

CSTC members can click here to log in to their member profile and get started with VeriFyle Pro!

Welcome New CSTC Members!

Please help us in joining our newest CSTC Members!

Christina Johnson

Inland Empire Chapter

Legislative Advocacy

CSTC has been the leading Association in supporting legislation to provide protection for our profession, to support our profession, and to enhance our profession. CSTC continuously leads our industry through legislative advocacy, educational opportunities, and professional inclusion.

CSTC works closely with a Legislative Consultant to keep an eye on important bills that would affect taxpayers and small business owners.

Please click here to view the bills that CSTC is currently monitoring.

Join the California Society of Tax Consultants!

Click here to fill out an online application.

CSTC advances professionalism within the tax industry by:

- Providing quality education

- Creating networking opportunities

- Advocating professional standards

|