|

In This Issue...

- From the President

- Registration for the 2019 Summer Symposium is OPEN!

- February Chapter Events

- News from the IRS

- News from CTEC

- Welcome New CSTC Members

- News from ADP - Obtain Legal Advice at a Fraction of the Cost!

- 60 Hour Online QE Course

- Join CSTC

CSTC Member Benefits

CSTC members have access to benefits such as free payroll processing services for your tax practice, and the opportunity to earn new revenue through their flexible partnership options.

CSTC is pleased to include the VeriFyle ProTM premium secure online document and message sharing service at no cost to CSTC members!

Wolters Kluwer: Discounts on Tax, Accounting & Audit Resources, Software, Information & Services.

CSTC members receive the TaxBook WebLibrary at a special price

Other Member Benefits Include:

$ Savings on all Society Educational Events

$ Savings on Contact, Correspondence & Self Study Education

$ Savings with member specialty CSTC Connects (previouslyYellow Pages) list

$ Savings with E & O Insurance, plus specialty coverage relevant to your profession

$ Online CSTC Find-a-Tax Consultant search to help promote your business!

$ CSTC Member Listserv

Office Depot has partnered with us to provide exclusive savings in-store and online, plus fantastic additional benefits. This program is all about providing preferred pricing to our clubs, and the savings extend to almost every item.

Savings include 20% to 55% off item office supply core list, 20% to 55% off retail on cleaning & break room items, 10% off branded; 20% off private brand ink & toner core list, Average 10% off retail on 200 technology core items, Free next-day shipping on orders of $50 or more, and SIGNIFICANT savings on copy & print. Become a CSTC member to sign up for our Office Depot Small Business Savings Program, administered by Excelerate America.

CSTC Mission

CSTC advances professionalism within the tax industry by:

- Providing quality education

- Creating networking opportunities

- Advocating professional standards

|

From the President

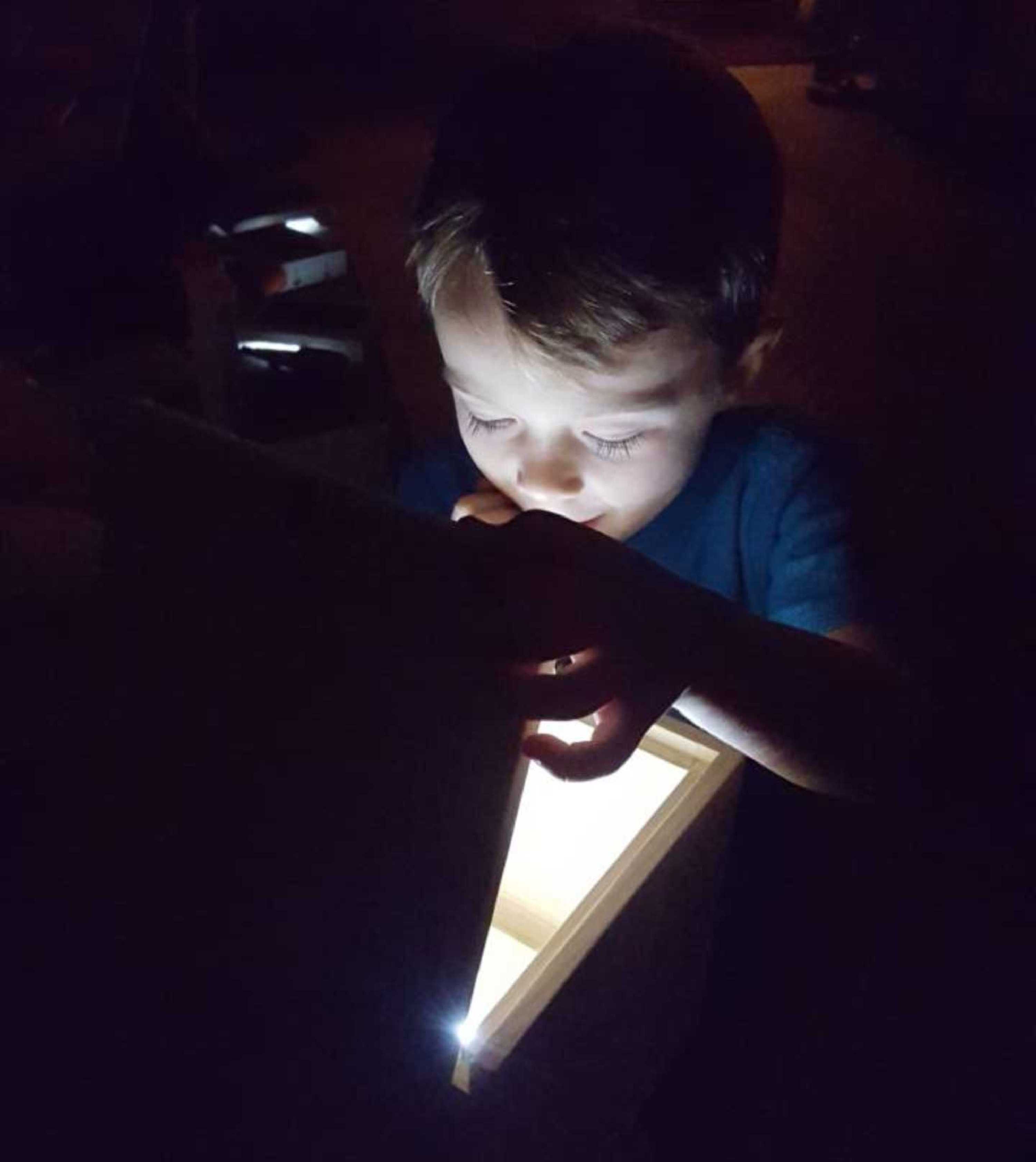

DYLAN AND HIS MAGIC BOX

This past Christmas my five-year-old grandson Dylan said that while he was visiting my wife, Cheryl, and I for Christmas he wanted to make something with me out of wood that he could take home. We decided to build a box. With the supplies I had available, we settled on an eight inch cube of three-quarter inch clear pine with a hinged lid and special latch. Dylan and I worked together during every stage of the design and build process. With the help of my son Tyler, who was also visiting for Christmas, we concluded that the easiest and strongest way to build the box was to use double rabbet joints because they could easily be done with my router. The end result was a beautiful 8 x 8 x 8 box, strong enough to stand on, with a latch that could keep his little brother out.

Before we got started Dylan had no idea what a rabbet joint was nor did he realize how much work was involved in making a small wooden cube. After we cut, rabbeted, fitted, glued, clamped, sanded, stained, and finished the box, he realized what it takes to turn an idea into a finished product. I remember so vividly the look on his face when he got to open the finished box for the first time. He was so proud that he’d worked long and hard and the end result was fantastic. Before we got started Dylan had no idea what a rabbet joint was nor did he realize how much work was involved in making a small wooden cube. After we cut, rabbeted, fitted, glued, clamped, sanded, stained, and finished the box, he realized what it takes to turn an idea into a finished product. I remember so vividly the look on his face when he got to open the finished box for the first time. He was so proud that he’d worked long and hard and the end result was fantastic.

As Dylan’s grandpa, building the box was not the best part of the experience. The best part of the experience was working with him and teaching him a skill that he won’t forget, helping him appreciate the creative process and work involved, and providing him with a treasure that will trigger memories of working together with me and his uncle Tyler.

I tell the story, first because it is true and I like it, and second because it’s a simple example of the effort required to learn a new skill. For most people, if they want an eight inch wooden cube box they go to a craft store and buy one or they go online to a website like Etsy to make the purchase. The only effort required is the searching and providing the cash. It is the same in the tax profession? Do you think that people really appreciate what it takes to provide a professional finished tax product. After all, it’s just a tax return, right? Don’t you just put some numbers in a computer and out comes the tax return? Isn’t it something that anyone can do if they have a computer? You’re probably thinking the same thing I am “Ha!”

Most people have no idea how many hours of education and study is required to properly prepare a tax return. They have no idea that you study your craft in education events 30 to 50 hours per year – every year. There are not many professions that require that type of study. There are not many professions where the laws change so dramatically every year. Our goal at CSTC is to be right there with you during the learning process and provide excellent education so that every precious hour you study is effective in helping you perfect your trade.

In my 30 years with CSTC, my favorite part has been the ability to call anyone on the CSTC roster, ask them questions, and get great answers and feedback. Because of the willingness to share, CSTC is different than every other professional organization that I belong to. I have spoken to different to groups all over California and out of every tax group, attorney group, or professional association, I favor spending time with members of CSTC because of their camaraderie and cooperation with each other in learning and carrying out their profession.

I am thrilled and humbled to have been elected your president for 2019 and promise to do my very best to advance our mission statement of improving the tax industry one professional at a time. I am convinced that, as a group, we can learn more, have more fun, and improve the tax industry. I am thrilled and humbled to have been elected your president for 2019 and promise to do my very best to advance our mission statement of improving the tax industry one professional at a time. I am convinced that, as a group, we can learn more, have more fun, and improve the tax industry.

Be sure to invite your friends and colleagues to our meetings and events this year!

Gary A. Quackenbush, Esq.,

President

2019 Summer Symposium

June 9-12 2019

Westgate Las Vegas Resort & Casino

Registration is Open for the 2019 Summer Symposium!

**Save $20 if you register by February 15, 2019**

Schedule-at-a-Glance

| |

Sunday, June 9, 2019

|

| 3pm |

Registration Opens; Exhibitor Set-up |

| 5:20pm-6pm |

Welcome Reception for First Time Attendees |

| 6pm-9pm |

Welcome Dinner

This event is family friendly.

(Included with full registration. Guest registration is $40) |

| |

Monday, June 10, 2019

|

| 6:30am-5pm |

Registration and Exhibits |

| 7:30am-9:00am |

Session 1: IRS Keynote Presentation and Breakfast

Speaker TBA |

| 9:15am-10:05am |

Breakout Sessions (all sessions will continue after the break): |

| |

Session 2: 199A - Qualified Business Income Deduction

Claudia Stanley, CPA, EA

|

| |

Session 3: 1031 Exchanges and Their New Counterpart - Opportunity Zones

Ruth Godfrey, EA |

| |

Session 4: Reporting K-1's for Tax

Jane Ryder, EA, CPA |

| |

Session 5: Toilets, Tenants & Trash: Capital Gains Tax Reduction Strategies

Frank Acuña, Attorney at Law |

| 10:05am-10:20am |

Break with Exhibitors |

| 10:20am-12:00pm |

Breakout Sessions (continued from before the break): |

| |

Session 2 Continued: 199A - Qualified Business Income Deduction

Claudia Stanley, CPA, EA

|

| |

Session 3 Continued: 1031 Exchanges and Their New Counterpart - Opportunity Zones

Ruth Godfrey, EA |

| |

Session 4 Continued: Reporting K-1's for Tax

Jane Ryder, EA, CPA |

| |

Session 5 Continued: Toilets, Tenants & Trash: Capital Gains Tax Reduction Strategies

Frank Acuña, Attorney at Law |

| 12:00pm-1:20pm |

Lunch on own |

| 1:20pm-3:00pm |

Breakout Sessions: |

| |

Session 6: California Old School Differences

Eugene Ostermiller, EA, NTPI Fellow |

| |

Session 7: Advanced Schedule C Audits

LG Brooks, EA, CTRS |

| |

Session 8: The Sharing Economy

Karen Joyner, EA |

| |

Session 9: How to Serve Immigrant Mixed-Status Families

Antonio Martinez, EA |

| 3:00pm-3:20pm |

Break with Exhibitors |

| 3:20pm-5:00pm |

Session 10: Cryptocurrency, the IRS, and You

John Miller, EA |

| |

Session 11: Marijuana Taxation in California

William Rogers, MBA, CFP, EA |

| |

Session 12: Dependency in Depth

Shannon Hall, EA |

| |

Session 13: Tax Issues for US Citizens Abroad

Monica Haven, EA, JD, LLM

|

| 5:00pm-6:00pm |

Reception with Exhibitors |

| 6:00pm |

Evening on Own |

| |

Tuesday, June 11, 2019

|

| 6:30am-5pm |

Registration and Exhibits |

| 7:30am-9:00am |

Session 14: California Keynote Presentation and Breakfast

Speaker TBA |

| 9:00am-9:15am |

Break |

| 9:15am-10:05am |

Breakout Sessions (all sessions will continue after the break): |

| |

Session 15: Appealing Decisions - Audit, OIC, Tax Court, Bankruptcy Court, Federal District Court

Gary Quackenbush, Esq |

| |

Session 16: Everything S-Corp!

Jane Ryder, EA, CPA |

| |

Session 17: Baby, Oh Baby!

Karen Joyner, EA |

| |

Session 18: Engagement Letters

LG Brooks, EA, CTRS |

| 10:05am-10:20am |

Break with Exhibitors |

| 10:20am-12:00pm |

Breakout Sessions (continued from before the break): |

| |

Session 15 Continued: Appealing Decisions - Audit, OIC, Tax Court, Bankruptcy Court, Federal District Court

Gary Quackenbush, Esq |

| |

Session 16 Continued: Everything S-Corp!

Jane Ryder, EA, CPA |

| |

Session 17 Continued: Baby, Oh Baby!

Karen Joyner, EA |

| |

Session 18 Continued: Engagement Letters

LG Brooks, EA, CTRS |

| 12:00pm-1:20 pm |

Lunch on own |

| 1:20pm-3:00 pm |

Breakout Sessions: |

| |

Session 19: Passive Activity Loss Limitations

Eugene Ostermiller, EA, NTPI Fellow |

| |

Session 20: What's my Character?

Claudia Stanley, CPA, EA

|

| |

Session 21: Domestic Tax Issues for Non-Resident Aliens

Monica Haven, EA, JD, LLM

|

| |

Session 22: The Art and Science of Divorce Taxation in 2019

Armand D'Alo, EA, CFP, CDFA and Robbin D'Alo, EA, CLA, CDFA |

| 3:00pm-3:20pm |

Break with Exhibitors |

| 3:20pm-5:00pm |

Session 23: California: Do You see What I CA?

Shannon Hall, EA |

| |

Session 24: Correcting Depreciation - Form 3115 Line-by-Line

Karen Joyner, EA |

| |

Session 25: Residents/Non-Residents

Antonio Martinez, EA |

| |

Session 26: Choice Of Entity. LLC, INC, LP, GP, SP - How To Choose?

Gary Quackenbush, Esq |

| 5:00pm |

Evening on Own |

| |

Wednesday, June 12, 2019

|

| 6:30am-5pm |

Registration and Exhibits |

| 7:30am-9:00am |

Session 27: Best Practices - Compliance and Documentation Presentation and Breakfast

Monica Haven, EA, JD, LLM

Class to continue after the break |

| 9:00am-9:15am |

Break |

| 9:15am-10:05am |

Session 27 Continued: Best Practices - Compliance and Documentation Presentation and Breakfast

Monica Haven, EA, JD, LLM

|

| 10:05am-10:20am |

Break with Exhibitors |

| 10:20am-12:00pm |

Breakout Sessions: |

| |

Session 28: Compensatory Stock & LLC Benefits (Options RSU's, ESPP, Etc)

Jane Ryder, EA, CPA |

| |

Session 29: Fresh Starts - Installment Agreement, OIC, Tax Lien Relief, Bankruptcy, Innocent Spouse, Injured Spouse

Gary Quackenbush, Esq |

| |

Session 30: How to Read a Trust

Frank Acuña, Attorney at Law |

| |

Session 31: Tax Penalties & Abatement

LG Brooks, EA, CTRS |

| 12:00pm-1:20pm |

Lunch on Own |

| 1:20pm-3:00pm |

Session 32: Stump the Tax Experts

|

| 3:00pm-3:20pm |

Break |

| 3:20pm-5:00pm |

Session 33: Ethics - What Would You Do?

Claudia Stanley, CPA, EA

|

| 5:15pm |

Grand Prize Drawing |

Registration Fees

| Category |

By 2.15.19 |

By 3.15.19 |

By 4.19.19 |

After 4.19.19 |

| Members |

$455 |

$475 |

$525 |

$575 |

| Staff of Members |

$480 |

$500 |

$550 |

$600 |

| Non-Members |

$555 |

$575 |

$625 |

$675 |

| Sunday Social Event Guest Tickets |

$40 |

$40 |

$40 |

$40 |

Click here to visit the 2019 Summer Symposium page to learn about our topics, speakers, and more!

February 2019 Chapter Events

February 5, 2019

Topic: Round Table Discussion

North County San Diego Chapter Meeting

1 Federal Law Hour

February 5, 2019

Topic: 2019 Breakfast Meeting

Inland Empire Chapter Meeting

No CE Offered

February 6, 2019

Topic: How to Reduce Taxable Income for 199A Deduction Through Retirement Planning After Year End

San Francisco Bay Chapter Meeting

2 Federal Law Hours

February 7, 2019

Topic: Share and Solve Breakfast Meetings

Temecula Valley Chapter Meeting

1 Federal Law Hour

February 10, 2019

Topic: Round Table Discussion

Central Valley Chapter Meeting

1 California Hour

2 Federal Update Hours

February 10, 2019

Topic: Round Table Discussion

Greater Long Beach Chapter Meeting

1 Federal Law Hour

1 Federal Update Hour

1 California Hour

February 19, 2019

Topic: 2019 Breakfast Meeting

Inland Empire Chapter Meeting

No CE Offered

February 24, 2019

Topic: Round Table Discussion

Greater Long Beach Chapter Meeting

1 Federal Law Hour

1 Federal Update Hour

1 California Hour

Click here to view the CSTC calendar.

IRS kicks off 2019 tax-filing season as tax agency reopens; Use IRS.gov to avoid phone delays

WASHINGTON ― The Internal Revenue Service successfully opened the 2019 tax-filing season today as the agency started accepting and processing federal tax returns for tax year 2018. Despite the major tax law changes made by the Tax Cuts and Jobs Act, the IRS was able to open this year’s tax-filing season one day earlier than the 2018 tax-filing season.

More than 150 million individual tax returns for the 2018 tax year are expected to be filed, with the vast majority of those coming before the April tax deadline. Through mid-day Monday, the IRS had already received several million tax returns during the busy opening hours.

"I am extremely proud of the entire IRS workforce. The dedicated IRS employees have worked tirelessly to successfully implement the biggest tax law changes in 30 years and launch tax season for the nation," said IRS Commissioner Chuck Rettig. “Although we face various near- and longer-term challenges, our employees are committed to doing everything we can to help taxpayers and get refunds out quickly."

Following the government shutdown, the IRS is working to promptly resume normal operations.

“The IRS will be doing everything it can to have a smooth filing season,” Rettig said. “Taxpayers can minimize errors and speed refunds by using e-file and IRS Free File along with direct deposit.”

The IRS expects the first refunds to go out in the first week of February and many refunds to be paid by mid- to late February like previous years. The IRS reminds taxpayers to check “Where’s My Refund?" for updates. Demand on IRS phones during the early weeks of tax season is traditionally heavy, so taxpayers are encouraged to use IRS.gov to find answers before they call.

April deadline; help for taxpayers through e-file, Free File

The filing deadline to submit 2018 tax returns is Monday, April 15, 2019, for most taxpayers. Because of the Patriots’ Day holiday on April 15 in Maine and Massachusetts and the Emancipation Day holiday on April 16 in the District of Columbia, taxpayers who live in Maine or Massachusetts have until April 17 to file their returns.

With major changes made by the Tax Cuts and Jobs Act, the IRS encouraged taxpayers seeking more information on tax reform to consult two online resources: Publication 5307, Tax Reform: Basics for Individuals and Families, and Publication 5318; Tax Reform What’s New for Your Business. For other tips and resources, visit IRS.gov/taxreform or check out the Get Ready page on IRS.gov.

The IRS expects about 90 percent of returns to be filed electronically. Choosing e-file and direct deposit remains the fastest and safest way to file an accurate income tax return and receive a refund.

The IRS Free File program, available at IRS.gov, gives eligible taxpayers a dozen options for filing and preparing their tax returns using brand-name products. IRS Free File is a partnership with commercial partners offering free brand-name software to about 100 million individuals and families with incomes of $66,000 or less. About 70 percent of the nation’s taxpayers are eligible for IRS Free File. People who earned more than $66,000 may use Free File Fillable Forms, the electronic version of IRS paper forms.

Most refunds sent in less than 21 days; EITC/ACTC refunds starting Feb. 27

The IRS expects to issue more than nine out of 10 refunds in less than 21 days. However, it’s possible a tax return may require additional review and take longer. “Where’s My Refund?” has the most up to date information available about refunds. The tool is updated only once a day, so taxpayers don’t need to check more often.

The IRS also notes that refunds, by law, cannot be issued before Feb. 15 for tax returns that claim the Earned Income Tax Credit or the Additional Child Tax Credit. This applies to the entire refund — even the portion not associated with the EITC and ACTC. While the IRS will process the EITC and ACTC returns when received, these refunds cannot be issued before Feb. 15. Similar to last year, the IRS expects the earliest EITC/ACTC related refunds to actually be available in taxpayer bank accounts or on debit cards starting on Feb. 27, 2019, if they chose direct deposit and there are no other issues with the tax return.

“Where’s My Refund?” on IRS.gov and the IRS2Go mobile app remain the best way to check the status of a refund. “Where’s My Refund?” will be updated with projected deposit dates for most early EITC and ACTC refund filers on Feb. 17, so those filers will not see a refund date on “Where's My Refund?” or through their software packages until then. The IRS, tax preparers and tax software will not have additional information on refund dates, so these filers should not contact or call about refunds before the end of February.

This law was changed to give the IRS more time to detect and prevent fraud. Even with the EITC and ACTC refunds and the additional security safeguards, the IRS still expects to issue more than nine out of 10 refunds in less than 21 days. However, it’s possible a particular tax return may require additional review and a refund could take longer. Even so, taxpayers and tax return preparers should file when they’re ready. For those who usually file early in the year and are ready to file a complete and accurate return, there is no need to wait to file.

New Form 1040

Form 1040 has been redesigned for tax year 2018. The revised form consolidates Forms 1040, 1040A and 1040-EZ into one form that all individual taxpayers will use to file their 2018 federal income tax return.

The new form uses a “building block” approach that can be supplemented with additional schedules as needed. Taxpayers with straightforward tax situations will only need to file the Form 1040 with no additional schedules. People who use tax software will still follow the steps they’re familiar with from previous years. Since nearly 90 percent of taxpayers now use tax software, the IRS expects the change to Form 1040 and its schedules to be seamless for those who e-file.

Free tax help

Low- and moderate-income taxpayers can get help filing their tax returns for free. Tens of thousands of volunteers around the country can help people correctly complete their returns.

To get this help, taxpayers can visit one of the more than 12,000 community-based tax help sites that participate in the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. To find the nearest site, use the VITA/TCE Site Locator on IRS.gov or the IRS2Go mobile app.

Filing assistance

No matter who prepares a federal tax return, by signing the return, the taxpayer becomes legally responsible for the accuracy of all information included. IRS.gov offers a number of tips about selecting a preparer and information about national tax professional groups.

The IRS urges all taxpayers to make sure they have all their year-end statements in hand before filing. This includes Forms W-2 from employers and Forms 1099 from banks and other payers. Doing so will help avoid refund delays and the need to file an amended return.

Online tools

The IRS reminds taxpayers they have a variety of options to get help filing and preparing their tax returns on IRS.gov, the official IRS website. Taxpayers can find answers to their tax questions and resolve tax issues online. The Let Us Help You page helps answer most tax questions, and the IRS Services Guide links to these and other IRS services.

Taxpayers can go to IRS.gov/account to securely access information about their federal tax account. They can view the amount they owe, pay online or set up an online payment agreement; access their tax records online; review the past 18 months of payment history; and view key tax return information for the current year as filed. Visit IRS.gov/secureaccess to review the required identity authentication process.

The IRS urges taxpayers to take advantage of the many tools and other resources available on IRS.gov.

The IRS continues to work with state tax agencies and the private-sector tax industry to address tax-related identity theft and refund fraud. As part of the Security Summit effort, stronger protections for taxpayers and the nation’s tax system are in effect for the 2019 tax filing season.

The new measures attack tax-related identity theft from multiple sides. Many changes will be invisible to taxpayers but will help the IRS, states and the tax industry provide additional protections, and tighter security requirements will better protect tax software accounts and personal information.

Renew ITIN to avoid refund delays

Many Individual Taxpayer Identification Numbers (ITINs) expired on Dec. 31, 2018. This includes any ITIN not used on a tax return at least once in the past three years. Also, any ITIN with middle digits of 73, 74, 75, 76, 77, 81 and 82 (Example: 9NN-73-NNNN) is now expired. ITINs that have middle digits 70, 71, 72 or 80 expired Dec. 31, 2017, but taxpayers can still renew them. Affected taxpayers should act soon to avoid refund delays and possible loss of eligibility for some key tax benefits until the ITIN is renewed. An ITIN is used by anyone who has tax-filing or payment obligations under U.S. tax law but is not eligible for a Social Security number.

It can take up to 11 weeks to process a complete and accurate ITIN renewal application. For that reason, the IRS urges anyone with an expired ITIN needing to file a tax return this tax season to submit their ITIN renewal application soon.

Sign and validate electronically filed tax returns

All taxpayers should keep a copy of their tax return. Some taxpayers using a tax filing software product for the first time may need their adjusted gross income (AGI) amount from their prior-year tax return to verify their identity.

Taxpayers using the same tax software they used last year will not need to enter their prior year information to electronically sign their 2017 tax return. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.

IRS will extend its transcript faxing service beyond the planned Feb 4 end date and is reviewing options for a new timeframe. We are committed to providing you with advance notice of the new date. As a reminder, you can now have unmasked Wage and Income Transcripts sent to your e-Services secure mailbox if you follow certain procedures. This should help bring clients into compliance and allow for electronic filing.

For details, please see Fact Sheet 2018-20, “Steps for tax professionals to obtain wage and income transcripts needed for tax preparation.” Additionally, due to the government shutdown, we are working hard to catch up on processing third-party authorization forms. We may also experience longer than normal wait times on our toll free telephone lines as our employees return to duty and we resume training and other filing season readiness activities. We ask for your patience as we work to resume normal operations.

Please be alert to upcoming communications regarding transcript issues.

IRS employees returned to work on January 28, 2019 and resumed activities. Upon their return to the office, they will begin to review mail, voice messages, and their audit and collection files as well as completing administrative tasks to reopen operations.

Click here for Collection Resumption FAQs from the IRS

Click here for Exam Resumption FAQs from the IRS

News from CTEC

New 2019 California Legislation

Changes CTEC Requirements for CRTPs

California Assembly Bill 3143 was signed into law in September with new provisions and requirements that will extend the CTEC program until January 1, 2023.

The renamed Tax Preparation Act (California Business and Professions Code Section 22250-22259) stipulates revisions that will impact CTEC Registered Tax Preparers (CRTPs).

CRTPs Must Provide CTEC’s Website to Clients Effective January 1, 2019, CRTPs must provide the CTEC website, ctec.org, to clients in writing prior to rendering tax preparation services. This is in addition to other information already required - the tax preparer’s name, address, phone number and bond number.

Disciplinary Actions Against CRTPs Made PublicStarting July 1, 2019, CTEC will post on its website…

- All disciplinary actions taken against registrants by the Council, including - but not limited to - misconduct that resulted in a suspension or revocation of a CRTP registration.

- A list of registrants on probation, including the misconduct that resulted in the probation and any terms of probation.

Reporting Bond Claims

On or after July 1, 2019, a CRTP is required to report all paid claims against their surety bond to CTEC. CTEC is also required to post a notice of the paid surety bond claims on ctec.org.

More legislative changes are set to take effect in 2020. Please be sure to read the next CTEC newsletter (coming in January) for more information. If you have any questions, please contact the CTEC office at 877-850-2832.

Welcome New CSTC Members!

Please help us in joining our newest CSTC Members!

Gordon Anderson

San Gabriel Valley Chapter

Steve Anderson

Inland Empire Chapter

Dana Ganal

Temecula Chapter

Patricia Juarez

Inland Empire Chapter

Sandra Lara

San Diego Chapter

Carol Ludlow

San Jose Chapter

Ruth Maloney

Sacramento Chapter

Elaine Merrigan

Inland Empire Chapter

Andrew Miklusicak

San Diego Chapter

Rebeca Murillo

San Diego Chapter

James Randolph

Greater Long Beach Chapter

Gary Tasser

San Jose Chapter

Sandra Welch

San Diego North County Chapter

Julito Vea

San Jose Chapter

News from ADP

Obtain Legal Advice at a Fraction of the Cost!

Many employers are asking what policies and procedures must be put in place in order to be in compliance with the 2019 labor laws. Due to California’s constant change in the small business realm, ADP has created a new platform and service, offering a helping hand to employers. With this service, employers will be able to seek legal advice at a fraction of the cost of hiring an attorney.

Looking for more information? Contact Chelsea Prazma, CSTC ADP Representative.

[email protected]

619-688-2711

60 Hour Online QE Course

45 Federal Law Hours & 15 CA Hours

Powered by The Income Tax School

If you wish to become a tax preparer in the state of California, you need to visit the California Tax Education Council (CTEC) website as you will need to register to become a California Registered Tax Preparer (CRTP).

How to Become a CRTP and Who Must Register?

All CTEC Registered Tax Preparers (CRTPs) must…

- First complete 60-hours (45 hours federal and 15 hours state) of qualifying tax education from a CTEC Approved Provider

- Obtain a PTIN (Preparer Tax Identification Number) from the IRS

- Purchase a $5,000 tax preparer bond

- Register with CTEC within 18 months from the completion date on the certificate of completion

Comprehensive Tax Course Package Includes:

- Online, self-study beginner tax course

- Study anywhere/anytime with an internet connection

- No prerequisites required.

- Divided into 4 modules, 5 chapters per module, a total of 20 chapters, a total of 60 CE credit hours

- FREE academic support from tax school instructors provided by email

Price: $299 online only or $351 online with books

With Books:

Order this course with books and you will receive all of the reading materials that are viewable online to be printed and bound for your easy reference while completing the course. (Prices of books are included in shipping costs.)

Join the California Society of Tax Consultants!

Click here to fill out an online application.

CSTC advances professionalism within the tax industry by:

- Providing quality education

- Creating networking opportunities

- Advocating professional standards

|