|

In This Issue...

- From the President

- November Events

- Register for the CSTC Seminar

- Running Start

- Welcome New CSTC Members

- Legislative Advocacy

- News from the IRS

- Join CSTC!

CSTC Member Benefits

CSTC members have access to benefits such as free payroll processing services for your tax practice, and the opportunity to earn new revenue through their flexible partnership options.

CSTC is pleased to include the VeriFyle ProTM premium secure online document and message sharing service at no cost to CSTC members!

Wolters Kluwer: Discounts on Tax, Accounting & Audit Resources, Software, Information & Services.

CSTC members receive the TaxBook WebLibrary at a special price

Other Member Benefits Include:

$ Savings on all Society Educational Events

$ Savings on Contact, Correspondence & Self Study Education

$ Savings with member specialty CSTC Connects (previouslyYellow Pages) list

$ Savings with E & O Insurance, plus specialty coverage relevant to your profession

$ Online CSTC Find-a-Tax Consultant search to help promote your business!

$ CSTC Member Listserv

Office Depot has partnered with us to provide exclusive savings in-store and online, plus fantastic additional benefits. This program is all about providing preferred pricing to our clubs, and the savings extend to almost every item.

Savings include 20% to 55% off item office supply core list, 20% to 55% off retail on cleaning & break room items, 10% off branded; 20% off private brand ink & toner core list, Average 10% off retail on 200 technology core items, Free next-day shipping on orders of $50 or more, and SIGNIFICANT savings on copy & print. Become a CSTC member to sign up for our Office Depot Small Business Savings Program, administered by Excelerate America.

We are a professional full-service tax advisory firm in San Diego. Our goal is to provide a level of service for our clients that will exceed expectations in every possible way. We strive to offer a diverse level of services to meet the needs of the diverse community we have been working in for more than 30 years.

TaxMama's® EA Exam Course prepares tax professionals to do so much more than just pass the IRS' Special Enrollment Examination. This is an in-depth course that teaches tax law from the ground up. It explains how tax returns work, with examples of basic 1040s, Schedule Cs, 1065s, 1120s, and 1120Ss; you learn tax law, tax research, client representation for audits, appeals and collections.

If you are interested in buying or selling a practice, contact us today! ATB is operated by Enrolled Agents ensuring a complete understanding of our profession. Please give us a call at (855) 428-2225 or visit us online at www.ATBCAL.com for more information and to view our current listings.

CA DRE 02002824

CSTC Mission Statement

CSTC advances professionalism within the tax industry by:

- Providing quality education

- Creating networking opportunities

- Advocating professional standards

|

From the President

HAPPY THANKSGIVING!

Thanksgiving is pretty much my favorite holiday. I love Christmas with all its magic, the beautiful decorations, the wonderful spirit, and the thrill presents, but at Thanksgiving the expectations to make the holiday great are so much lower. Even with a big feast, Thanksgiving is a simpler holiday. Thanksgiving is simply a time to be with family and friends, to remember lost loved ones, and to enjoy time together.

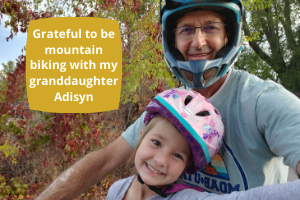

To say I am grateful for the Covid-19 pandemic would be an overstatement, and probably shock a few people, but I am grateful for the things learned so far during the pandemic. In speaking to friends, family, and clients about the situation, I have concluded that one of the greatest things about the pandemic is that it has helped us appreciate things that we have taken for granted. Keeping ‘socially distant’ has severely limited our time with others and has therefore made time together more precious. Having to wear a mask has made it so that seeing someone’s face without a mask is a refreshing experience. We have learned that even though things have been taken away, if we focus on what we have, we can feel a greater measure of gratitude and joy about life. I am personally grateful for good health, good doctors and hospitals, healthy kids and grandkids, a wonderful family, supportive friends, money to take care of my family’s needs, a great business, and all my senses. and probably shock a few people, but I am grateful for the things learned so far during the pandemic. In speaking to friends, family, and clients about the situation, I have concluded that one of the greatest things about the pandemic is that it has helped us appreciate things that we have taken for granted. Keeping ‘socially distant’ has severely limited our time with others and has therefore made time together more precious. Having to wear a mask has made it so that seeing someone’s face without a mask is a refreshing experience. We have learned that even though things have been taken away, if we focus on what we have, we can feel a greater measure of gratitude and joy about life. I am personally grateful for good health, good doctors and hospitals, healthy kids and grandkids, a wonderful family, supportive friends, money to take care of my family’s needs, a great business, and all my senses.

Sometimes we don’t appreciate what we have until it’s taken away. Is that not the theme of 2020: “Taken Away!” You know what I’m talking about, “this is being taken away starting tomorrow”, “you can’t do this anymore until we are in code yellow”, “if you’re going to do this you have these 5 restrictions.” You get the picture. You are living it too. Since so much has been taken away when we get a glimpse of getting it back, our gratitude is higher.

My wife Cheryl and I recently read the book “The Gratitude Diaries - how a year looking on the bright side can transform your life” written by American journalist and former Parade Magazine editor in chief Janice Kaplan. The book includes both personal stories and loads of supportive research. I enjoyed reading the book twice. When I say read, I mean listened to while I was either on my mountain bike, driving my truck, or exercising. Reading “The Gratitude Diaries” changed the way I see things. Though I try to be grateful and look on the bright side, I need a lot of work in that area and this book helped. I have learned in a big way that happiness has less to do with the events that occur than with our own attitude and perspective. Being grateful for and looking on the bright side of whatever happens has been proven over and over to make one’s life better.

Complaining is much easier than looking on the bright side because of how we are wired. We are wired and programmed to look for the negative or the harmful so that we can warn others about it. It used to be a matter of survival. Anciently, if you discovered a poisonous herb or berry you would tell everybody not to eat that herb or berry because it might make them sick or kill them. We do not live with those primitive conditions anymore and as a result we can focus on the good and acknowledge what went right. Being thankful and grateful does not mean that we lose our ambition. We can still want more for ourselves, our family, our career, or the world, but we can enjoy more along the way. Gratitude makes life not only more enjoyable but also worthwhile. John F. Kennedy declared: ”as we express our gratitude, we must never forget that the highest appreciation is not to utter words, but to live by them.”

How do we show more appreciation and become more grateful? How can we make Thanksgiving last all year? One awesome suggestion is to keep a gratitude journal. Some suggest that you simply write one thing that you grateful for each day and by doing so it helps you focus on what’s right with the world. This may sound a bit pollyannaish, but it works 100%! By keeping a gratitude journal, I have been able to focus better on what went right. I am committed from now on to maintain a daily gratitude journal and be better about appreciating what I have. The famous biblical writer Paul said that the highest a person can achieve is to be content with what they have and be ambitious for more. What great words to live by!

A WORD OF CAUTION

Be warned that writing in a gratitude journal might cause lower stress levels, might help you feel calmer, might give you a new perspective, might help you learn more about yourself, could cause you figure out and focus on what really matters, and might compel you to feel accomplished.

Every day I am grateful for my involvement with CSTC and how it has enriched my life professionally and personally. As I became involved in CSTC, I met many of my closest business associates. Some of the greatest lessons I have learned about myself and about my business came from my involvement in CSTC. This terrific organization is not just a provider of excellent continuing education, but a provider of opportunities for growth and development personally and professionally.

I am grateful for our leaders, directors, managers, operators, volunteers, and everybody that puts in any effort to make CSTC a better organization.

Thank you! Thank you! Thank you!

Have a wonderful Thanksgiving!

Your friend, Gary Quackenbush, CSTC president.

Calendar of Events

November 2020

November 4, 2020

Topic: TV Share and Solve Round Table Dinner Meeting

Temecula Valley Chapter In-Person Meeting

2 Federal Law Hours (Topics covering existing tax law)

Click here to learn more and register

Topic: The Tax Aspects of Divorce

San Francisco Bay Chapter Virtual Meeting

2 Federal Tax Law Hours (Topics covering existing tax law)

Click here to learn more and register

November 5, 2020

Topic: 2020 Tax Update

San Gabriel Valley Chapter In-Person Meeting

2 Federal Update hours (Topics covering new tax laws)

Click here to learn more and register

November 10, 2020

Topic: Keeping Your Office Secure

East County San Diego Chapter Virtual Workshop

2 Federal Tax Law Hours (Topics covering existing tax law)

Click here to learn more and register

November 11, 2020

Topic: Reporting Foreign Accounts & Assets: FBAR vs Form 8938

Orange County Chapter Virtual Meeting

2 Federal Tax Law Hours (Topics covering existing tax law)

Click here to learn more and register

November 12, 2020

Topic: Ethics - 2020: The COVID-19 Made Me Do It

North County San Diego Chapter Virtual Meeting

2 Ethics hours (Topics meeting the ethics requirements under Cir 230)

Click here to learn more and register

Topic: 2020 Tax Update - COVID, CARES, PPP, SECURE ACT

Orange County South Chapter Virtual Meeting

2 Federal Update hours (Topics covering new tax laws)

Click here to learn more and register

November 16, 2020

CSTC Board of Directors Meeting

9:00 AM to 12:00 PM

Virtual Meeting via Zoom

November 17, 2020

Topic: 2020 California EDD Payroll Update

Sacramento Chapter Virtual Meeting

2 California Hours (Topics covering California law issues)

Click here to learn more and register

November 18, 2020

Topic: Filing the Non-Filer

San Jose Chapter Virtual Meeting

2 Federal Law hours (Topics covering existing tax law)

Click here to learn more and register

Topic: When A Loved One Has Died (A Tax Professional’s Perspective)

Inland Empire Chapter Virtual Meeting

1 Federal Law hours (Topics covering existing tax law)

1 California hours (Topics covering California law issues)

Click here to learn more and register

Topic: Preachers, Teachers Truckers Etc

Greater Long Beach Chapter In-Person Meeting

2 Federal Law hours (Topics covering existing tax law)

Click here to learn more and register

November 19, 2020

Topic: Bankruptcy Secrets

San Diego Chapter Virtual Meeting

2 Federal Law hours (Topics covering existing tax law)

Click here to learn more and register

November 20, 2020

Topic: Partnership & LLC Form 1065 Fundamentals for 2020

Virtual Seminar Hosted by the California Society of Tax Consultants

2 Federal Law hours (Topics covering existing tax law)

2 Federal Update hours (Topics covering new tax laws)

Click here to learn more and register

November 24, 2020

Topic: TBA

Central Valley Chapter Virtual Meeting

Hours TBA

Click here to learn more

Click here to view the CSTC calendar.

Partnership & LLC Form 1065 Fundamentals for 2020 Seminar

Hosted by the California Society of Tax Consultants

Date:

Friday, November 20, 2020

9:00 AM to 12:10 PM

Location:

Virtual Meeting via Zoom

Description:

Significant changes will affect partnership tax returns for 2020. Guiding your clients through the compliance maze will be an important job for tax preparers for the upcoming tax season. Understanding these changes now will give you time for year-end planning and help you to deliver more value to your partnership clients. Topics to be covered during the webinar include:

•Learn new IRS compliance regulations for Form 1065 & Schedule K-1

•Strategies for maximizing QBI for partnerships

•New audit rules for partnerships

•All about Partnership Basis; Comprehensive basis calculations, compliance, issues, and reporting changes

•New Form 1065 & K-1 reporting requirements for 2020 and more

Register TODAY for Running Start

ON-DEMAND Webinar

Not just theory...Real-life application! All the latest news about how the CARES Act, the SECURE Act, the Disaster Act, and other recent legislation impact federal and CA tax returns, including new forms explained line-by-line.

Things you'll learn...

· Complete coverage of IRS & CA forms

· Latest news about the CARES Act, SECURE Act, Families First Relief Act, Disaster Act, and more...

· Reconciliation of advance payment (rebates) to stimulus credit

· How does PPP discharge affect tax return? Are expenses paid with loan proceeds deductible?

· New forms with real-life examples to show you how to complete them

· Line-by-line calculations on new forms & worksheets

· CA adjustments calculated and illustrated on Form 540 Sch CA

· Case studies – Client documents to completed tax return

· Court cases, revenue rulings, and more...

· Worksheets, flowcharts, and checklists to help you keep it all straight

· 400+ page manual mailed to you

· Free FAST FACTS reference card!

· NEW Free CA nonconformity reference card!

· Information you can use in the REAL WORLD!

This on-demand webinar will allow you to take the class whenever it is convenient for you, either all at once or a little bit each day. Attendees who register before December 1 will not receive their materials until December 1. Attendees who register after that date will receive their login information within three business days of registration. Books will be mailed to the address on the registration form within 7 business days of purchasing the course.

Welcome New CSTC Members!

Please help us in joining our newest CSTC Members!

Azucena Barclay

San Diego Chapter

Garry Browning

Central Valley Chapter

Cachet Campbell

Inland Empire Chapter

Paula Cathcart

North County San Diego Chapter

Zuzie Esquivel

Inland Empire Chapter

Hugo Gonzalez

Orange County Chapter

Julia Gutierrez

Orange County Chapter

Susan Leivas-Sturner

Inland Empire Chapter

Karin Nystrom Hudson

Los Angeles Chapter

Allison Pichler

Wine County Chapter

Nestor Requeno

Los Angeles Chapter

Monica Rosas

San Diego Chapter

Susana Soto

Los Angeles Chapter

Bill Stewart

Orange County Chapter

Amir Sunbaty

Los Angeles Chapter

Lydia Tinker

San Diego Chapter

Rick Torres

San Jose Chapter

Lourdes Witty

Inland Empire Chapter

Legislative Advocacy

CSTC has been the leading Association in supporting legislation to provide protection for our profession, to support our profession, and to enhance our profession. CSTC continuously leads our industry through legislative advocacy, educational opportunities, and professional inclusion.

CSTC works closely with a Legislative Consultant to keep an eye on important bills that would affect taxpayers and small business owners.

Please click here to view the bills that CSTC is currently monitoring.

Join the California Society of Tax Consultants!

Click here to fill out an online application.

CSTC advances professionalism within the tax industry by:

- Providing quality education

- Creating networking opportunities

- Advocating professional standards

|