|

CSTC's 2018 SUMMER TAX SYMPOSIUM

June 10-13, 2018

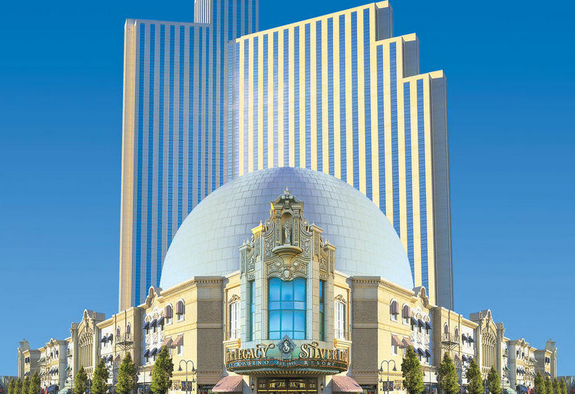

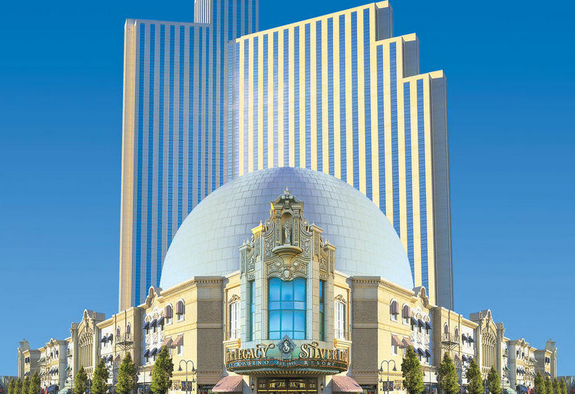

Silver Legacy Resort and Casino

Reno, Nevada

Celebrating the 32nd Symposium: A Night at the Movies

Featuring:

New Tax Laws ~ Marijuana ~ Disaster Relief

The California Society of Tax Consultants, Inc (CSTC), has been a nonprofit organization for the benefit of tax professionals throughout California since 1966 (formerly known as ISTC), and delivers quality education and unique member benefits. As a bookkeeper, accountant, Enrolled Agent, or CPA, you can take advantage of everything CSTC has to offer. Programs cover a wide spectrum of tax topics that are approved for CTEC, EA & CPA credit.

The 2018 Summer Symposium Committee has built a conference schedule featuring exceptional, top-notch, speakers! Beanna Whitlock, George Van Buren, LG Brooks, Claudia Stanley, Frank Acuna, Eugene Ostermiller, and Ruth Godfrey will be speaking, to name a few.

The CSTC Summer Tax Symposium is an event not to miss!

The Tax Specialist's Choice

Quick Links

Registration Information and Fees

Summer Tax Symposium Schedule-at-a-Glance

Session Descriptions

About the Presenters

CSTC Sponsor and Exhibitor Information

Thank you to the 2018 Summer Tax Symposium Exhibitors

Book Your Room and Plan Your Stay!

Thank you to the 2018 Exhibitors!

Tax Materials Inc., publishers of TheTaxBook

Spidell Publishing, Inc.

CFS Tax Software, Inc.

ADP

VeriFyle

IRS

Accounting & Tax Brokerage

Summer-Symposium Schedule-at-a-Glance

| |

Sunday, June 10, 2018

|

| 3pm |

Registration Opens; Exhibitor Set-up |

| 6pm-9pm |

Evening Event, “Night at the Movies”

Buffet Dinner begins at 6:30 p.m.

This event is family friendly.

(Included with full registration. Guest registration is $40) |

| |

Monday, June 11, 2018

|

| 7am-5pm |

Registration and Exhibits |

| 7am-8am |

Breakfast |

| 8am-11:40am |

Breakout Sessions: |

| |

Session 1: Death and (Income) Taxes: Administering an Estate or Trust after Death from a Tax Preparer's Perspective, Frank Acuna and Ruth Godfrey |

| |

Session 2: Trust Fund Recovery Penalty Issues & Case Studies, LG Brooks |

| |

Session 3: Business Basics, Claudia Stanley |

| 9:40am-10am |

Coffee Break |

| 11:40am-1:10pm |

Lunch Break - Options will be listed in the program book |

| 1:10pm-2:50pm |

Breakout Sessions: |

| |

Session 4: Tax Court Case Reviews, LG Brooks |

| |

Session 5: IRA Rules Every Tax Professional Must Know!, Frank Acuna |

| |

Session 6: Schedule A: What is Left, What Does California Say? Eugene Ostermiller |

| |

Session 7: Tax Services & Legalized Cannabis (continues below), Claudia Stanley |

| 2:50pm-3:20pm |

Refreshment Break |

| 3:20pm-5pm |

Breakout Sessions: |

| |

Session 7: Tax Services & Legalized Cannabis (continued), Claudia Stanley |

| |

Session 8: Filing Status, George Van Buren |

| |

Session 9: Cyber Security, Ruth Godfrey |

| |

Session 10: California Update: How do the federal changes impact California? Eugene Ostermiller |

| 5pm |

Session 11: Keynote IRS Presentation: Data Breaches and Business Email Compromises, Forrest Knorr |

| |

Tuesday, June 12, 2018

|

| 7am-5pm |

Registration and Exhibits |

| 7am-8am |

Breakfast |

| 8am-11:40am |

Breakout Sessions: |

| |

Session 12: OIC's from A's to Z's, LG Brooks and Beanna Whitlock |

| |

Session 13: 4797 Line by Line, Eugene Ostermiller |

| |

Session 14: Casualties & Disasters, Claudia Stanley |

| |

Session 15: Schedule C, George Van Buren |

| 9:40am-10am |

Coffee Break |

| 11:40am-1:10pm |

Lunch Break - Check the program book for options |

| 1:10pm-2:50 pm |

Breakout Sessions: |

| |

Session 16: The Notice of Deficiency & IRS AJAC, LG Brooks |

| |

Session 17: What to Do With A/B Trusts That No Longer Make Sense, Frank Acuna |

| |

Session 18: Gifts, Estates, and Trusts, Beanna Whitlock |

| |

Session 19: Non-Residents, Eugene Ostermiller |

| 2:50pm-3:20 pm |

Refreshment Break |

| 3:20pm-5 pm |

Breakout Sessions: |

| |

Session 20: California Update: How do the federal changes impact California? Eugene Ostermiller |

| |

Session 21: THOSE WONDERFUL K-1s, Ruth Godfrey |

| |

Session 22: Decedents Final 1040 and 1041, Beanna Whitlock |

| |

Session 23: Schedule E, George Van Buren |

| |

Wednesday, June 13, 2018

|

| 7am-5pm |

Registration and Exhibits |

| 7am-8am |

Breakfast |

| 8am-11:40am |

Session 24: 2018 Tax Cuts & Jobs Act, Beanna Whitlock |

| 9:40am-10am |

Coffee Break |

| 11:40am-1:10pm |

Lunch Break - Check the program book for options |

| 1:10pm-2:50pm |

Session 25: Tax Experts Panel, All Presenters |

| 2:50pm-3:20pm |

Refreshment Break |

| 3:20pm-5pm |

Session 26: Where Do You Keep Your Ethics? Beanna Whitlock |

| 5:15pm |

Grand Prize Drawing |

Registration Information and Fees

| Category |

|

|

Fee |

| Members |

|

|

$575 |

| Staff of Members |

|

|

$600 |

| Non-Members |

|

|

$650 |

| Sunday Social Event Guest Tickets |

|

|

$40 |

Registration fees include: Educational sessions and materials, Daily Breakfasts, Sunday Evening Social & Buffet, and Refreshment Breaks.

Cancellation policy: Written/emailed requests for a registration fee refund will be accepted until May 15, 2018. A $100 administrative fee will be deducted from all refunds. No refund of any kind will be given if written cancellation notice is received after May 15, 2018. There are no refunds for no-show registrants.

CLICK HERE for the online registration form.

CLICK HERE to download a registration form: Please be sure to indicate your class session numbers on the form.

Book Your Room! Book Your Room!

Silver Legacy Resort and Casino

407 North Virginia Street

Reno, Nevada 89501

1-800-687-8733

http://www.silverlegacyreno.com/

$65 plus tax/fees and a resort fee of $18 per night Single/Double occupancy through May 9, 2018 by 5 p.m. PST or until block sells out.

Discount Code CSTC18

About the hotel: Located in the heart of Downtown Reno, The Silver Legacy Resort Casino is a 1,720 room premier destination, boasting every amenity for a perfect getaway: elegant guest rooms and suites, top-name entertainment, six fabulous restaurants, Catch A Rising Star Comedy Club, 85,000 square feet of thrilling gaming space with all of the newest games and 90,000 square feet of state-of-the-art convention space. Guests can also enjoy elegant boutique shopping, an award-winning health spa, the world's largest composite dome and mining rig, Rum Bullions Island Bar - Reno's only rum bar and the ultra hip Drinx Lounge and the upscale Aura Ultra Lounge. Silver Legacy is connected by skywalks to the Eldorado Hotel Casino and Circus Circus Reno providing guests with the largest center for gaming and entertainment in northern Nevada, all just 3 blocks from Reno's Riverwalk and arts district and within minutes of world-class skiing, golfing and more.

The Resort Fee Includes:

In-room guest coffee, Daily Wireless Internet Access for two devices, Daily Health Spa Admission, Bonus Resort Credits, Unlimited Local and Toll-free Calls, Valet Parking, Covered Self Parking, Airport Shuttle, Concierge Notary Services, Boarding Pass Printing at the Concierge Desk and Bell Desk. Please note, check-in time is 3 p.m. and check-out time is 11 a.m.

Session Descriptions and Presenter Bios

Sunday, June 10, 2018

3 PM - Registration Opens; Exhibitor Set-up

6 PM - 9 PM - Evening Event, “Night at the Movies”

Buffet dinner will begin at 6:30 p.m. This is a family friendly event.

Get to know the Speakers, Vendors, Conference Committee, and other tax professionals!

Monday, June 11, 2018

Session 1: Death and (Income) Taxes Administering an Estate or Trust after Death from a Preparer’s Perspective, Frank Acuña and Ruth Godfrey

Your client has died. Maybe they had a living trust, maybe they didn’t. Their children have asked you to assist with winding up their estate or trust. What do you do? Estate tax is not an issue, but income tax reporting and possibly estate/trust accounting must be done.

This course is taught by an attorney who is a certified specialist in estates and trusts and a very experienced enrolled agent. We will cover the basics (and some advanced topics) of estate and trust administration, final Form 1040, and Form 1041 for administrative trusts and trusts that continue after death. Be ready for lots of examples and pencil-to-paper exercises!

General/Some Hands On

4 Hours Federal Tax Law

Session 2: Trust Fund Recovery Penalty Issues & Case Studies, LG Brooks

Recent developments in enforcement and change in administrative and legal procedure have had a direct affect upon the assessment & application of the provisions of the “Trust Fund Recovery Penalty” (TFRP). Enforcement and application of criminal elements have been heightened and the IRS has elevated the pursuit of this matter by issuing the dreaded “Letter 903” in addition to the TFRP dilemma.

This presentation is designed to explore, discuss & expose the critical elements of the potential assessment of the TFRP. During this course we will also participate in the development of appropriate defenses of & legal arguments to the proposed assessment of the TFRP through “interactive” and “hands-on” case studies. All case studies will be based upon actual Tax Court & District Court decisions & IRS published determinations.

Intermediate/Advanced

3 Hours Federal Tax Law

1 Hour Federal Tax Law Update

Session 3: Business Basics, Claudia Stanley

This is a beginner course designed for those who want to start preparing business returns—Schedule C, Partnerships, Corporations, LLCs. What’s deductible, what forms are required, and when to enlist the help of another professional. The biggest emphasis will be on Schedule C’s, but we will introduce and discuss entity basics, differences, and the pitfalls.

Basic/General

3 Hours Federal Tax Law

1 Hour CA State Law

Session 4: Tax Court Case Reviews, LG Brooks

It has been noticed that many Tax Practitioners, Tax Representatives as well as Tax Preparers operate under the pretense that since they are not actually an Attorney or a Tax Court Practitioner that their judicial awareness of the decisions of the United States Tax Court (Court) is not necessary. However, every practitioner, representative and preparer is affected by the decisions of this Court. Additionally, any EA’s and/or CPA’s that represents any taxpayer before the IRS may eventually assist their client in this Court and should be prepared to facilitate the “pro se” taxpayer’s presentation of their tax matters.

This presentation is designed to explore, discuss & explain the most recent & most pertinent Tax Court Cases that affect the practitioner community and also demonstrate how to effectively interpret the decisions of the Court to enhance your tax practice.

Intermediate/Advanced

2 Hours Federal Tax Law

Session 5: IRA Rules Every Tax Professional Must Know! Frank Acuña

Tax professionals are called on to advise clients about more than taxes. What are the options when designating retirement account beneficiaries? Are there optimum strategies to reduce taxes during retirement and for the next generation? Is there any way to control a beneficiary’s use of an IRA?

This course examines cutting edge tax reduction strategies for retirement accounts, and common beneficiary designations and which ones to avoid. The rules concerning required distributions will be explained, as will recent changes, which permit IRA Conduit Trusts (and why they are absolutely necessary for asset protection).

General/Some Hands On

2 Hours Federal Tax Law

Session 6: Schedule A: What is Left, What Does California Say? Eugene Ostermiller

Schedule A: With the passage of tax reform in December, the Schedule A has been totally rewritten. What is Left, What Does California Say? In this 2-hour session, we will review the Schedule A changes and then discuss what California will do in response to all of the new differences.

General

1 Hour Federal Tax Law

1 California State Hour

Session 7: Tax Services & Legalized Cannabis, Claudia Stanley

This course will cover how to legally and ethically provide tax services to the marijuana industry: What’s deductible, what’s not; Pitfalls of a cash industry; Understanding 280E; Filing 8300; Inventory tracking; What activities are trafficking and which ones are not; Understanding what constitutes money laundering; and, What are the risks for professional advisors?

General/Intermediate

3 Hours Federal Tax Law

1 Hour CA State Law

Session 8: Filing Status – It’s Not Always Straightforward and Easy to Choose, George Van Buren:

One of the first things practitioners learn in the tax business is the different statuses available to taxpayers. Choosing the correct filing status is extremely important. The amount a taxpayer ultimately has to pay the IRS rests in large part on the filing status, Once it has been determined that the taxpayer has a filing requirement, the next thing is to decide their correct filing status. That may sounds simple, however, it can be quite confusing. Why, would something so simple be confusing? The reason lies in our complex tax code with sometimes violates not only logic, but also common sense. For, example, we have a tax system where a “qualifying relative” doesn’t have to be have to be related to you and where a taxpayer who is married can be considered “unmarried” for tax purposes. Now throw into the mix the various rules regarding same-sex marriage it’s made even more difficult. This seminar will include an in-depth look at the different filing statuses and how they are determined with particular emphasis on Head of Household (HOH). We will also discuss some of the non-traditional families and how the filing status affects them.

General

2 Hours Federal Tax Law

Session 9: Cyber Security, Ruth Godfrey

Do you invite intruders into your office? Do you check “Later” when your software gives you the option about an upgrade? Do you know where your employees are “going?” Are your employees on your side? Do you know the Cloud can open up and drop you through? What are the newest threats to our peace of mind? Spend two hours learning how to protect your office, computers, and you!

General

2 Hours Federal Tax Law

Session 10: California Update: How do the federal changes impact California? Eugene Ostermiller

California Update: How do the federal changes impact California? We will review this in depth in addition to other things California has in store for professional tax preparers.

General

2 Hours California State Law

Session 11: Keynote Presentation: Data Breaches and Business Email Compromises, Forrest Knorr

It is almost impossible to be in the return preparation business and not collect or hold personally identifying information — names and addresses, Social Security numbers, etc., about your clients and employees. If this information is lost or stolen, it could put these individuals at risk for identity theft. However, not all compromises of personal information result in identity theft. The type of personal information compromised can significantly affect the degree of potential damage. In this seminar, you will increase your understanding identity and data theft scams, and the impact on you and your clients. The learning objectives of this presentation are to increase awareness about data loss thefts, where information ends up if lost or stolen, how to protect taxpayer information and actions to take when compromised.

General

1 Hour Federal Tax Law

Tuesday, June 12, 2018

Session 12: OICs from A’s to Z’s, LG Brooks and Beanna Whitlock

The rules, regulations, and internal guidelines pertaining to the filing of an “Offer-in-Compromise” have changed significantly for all taxpayers (individuals and businesses). Strict adherence to these new rules and guidelines is critical with respect to the ultimate acceptance of the taxpayers’ request. Therefore, knowing what to expect from the IRS Offer Division and more importantly how to properly respond are pertinent elements of presenting a successful case.

General/Hands-on

2 Hours Federal Tax Law

1 Hours Federal Tax Law Update

1 Hour CA State Law

Session 13: 4797 Line by Line, Eugene Ostermiller

4797 Line by Line: In this four hour federal tax law session, we will be discussing sections 1231, 1245, 1250 property assets. As well, we will do a problem line by line in class to go through the form 4797 together to see how it works. Please bring pencils and a calculator for this session.

Hands On

4 Hours Federal Tax Law

Session 14: Casualties & Disasters, Claudia Stanley

This course will cover assisting taxpayers who experience a casualty or are in a disaster area. Instruction will cover the fundamentals of claiming losses (or gains) related to these events. We’ll also look at what to do when records are destroyed. This course will include the recent Disaster Tax Act and changes to claiming losses made by the Tax Cuts and Jobs Act.

General

3 Hours Federal Tax Law

1 Hour CA State Law

Session 15: Schedule C– Real Businesses and Fake Businesses, George Van Buren

If taxpayers engages in a business with the objective of making a profit, they can generally claim all their proper business deductions. If the taxpayer’s business deductions exceed their income for the ta year, they can claim a loss for the year, up to the amount of the taxable income from other activities. Any remaining losses may be carried over into other year. Unfortunately, may taxpayers are filing Schedule Cs for fake businesses just to use losses against legitimate income.

However, if the IRS deems the business to have no profit motive (an activity not engage in for profit) the ability to deduct losses is limited to the amount of income generated by the activity. These are the “Hobby Loss Rules” under IRC 183. A “hobby” cannot generate a tax loss that can be used to offset other taxable income on your tax return. Losses incurred by individuals, partnerships and S corporations in connection with a hobby are generally deductible only to the extent of the income produced by the hobby.

The Treasury Inspector General for Tax Administration (TIGTA) said in a recent report that many schedule C filers engage in tax abuse or “fake” businesses by reporting significant hobby losses to offset regular income. TIGTA also said in their report that 73% of these returns were filed by professional ta practitioners.

This seminar will include not only a discussion of the above information, but also a review of the nine (9) points the IRS will look at if they suspect an activity is not engaged in for profit. We will also discuss various audit flags the taxpayer should be aware of and review some key court cases in this area.

Intermediate

4 Hours Federal Tax Law

Session 16: The Notice of Deficiency & IRS AJAC, LG Brooks

The issuance of a “Notice of Deficiency” (Stat Notice) entitles a taxpayer to certain “judicial rights” with respect to pursuing further administrative remedies and/or a potential litigation resolution. However, due to the implementation of the “Appeals Judicial Approach Cultural” (AJAC) initiative, a significant number of State Notice’s are expected to be issued, which will force the taxpayer into litigation or force the taxpayer to forfeit their right to resolution.

This presentation is designed to discuss & explain the legal guidelines, requirements & critical effect related to the issuance of the “Notice of Deficiency” as well as the adverse implications of the AJAC initiative as it relates to the legal/judicial parameters of the Notice of Deficiency.

Intermediate/Advanced

2 Hours Federal Tax Law

Session 17: What to Do With A/B Trusts That No Longer Make Sense, Frank Acuña

This session examines subtrust funding requirements when a first spouse has died and the unusual situations in which tax professionals and fiduciaries find themselves. Pencil-to-paper problems funding subtrusts in compliance with IRS requirements will be examined. Continuing reporting requirements on 1041s and 706s will be discussed. Finally, the pitfalls and litigation issues that arise during trust administration will be discussed. In this session you will learn:

• Subtrust funding requirements (bypass trusts, QTIP trusts, etc.);

• How to recognize common problems and how to avoid or eliminate them; and,

• How to Identify (and avoid) disputes between beneficiaries and trust litigation?

General/Some Hands On

2 Hours Federal Tax Law

Session 18: Gifts, Estates, and Trusts, Beanna Whitlock

During Gifts, Estates, and Trusts, a two-hour, intermediate session, attendees will learn about Forms 709 and 706 and the requirements of filing with update of new tax legislation. Attendees will also learn about the issues of portability, valuations, and other critical information. Form 1041 will be discussed, "Who Do You Trust."

Intermediate

2 Hours Federal Tax Law

Session 19: Non-Residents, Eugene Ostermiller

Non-Residents: When do you file a 1040 or 1040NR? What is a dual status return or a dual status statement? In this intermediate, two hour federal tax law session, we will review the basics of how to prepare a United States Return for non-citizens.

Intermediate

2 Hours Federal Tax Law

Session 20: California Update: How do the federal changes impact California? Eugene Ostermiller

California Update: How do the federal changes impact California? We will review this in depth in addition to other things California has in store for professional tax preparers.

General

2 California State Hours

Session 21: THOSE WONDERFUL K-1s, Ruth Godfrey

Is your client an investor? Does he own a business entity? Did someone place money in a trust for your client? Did someone die and leave your client an estate? Where does all that information go on my client’s return? The K-1 shows big losses – so I’ll just wash out my client’s AGI and he won’t owe any taxes – right? Basis – what does that have to do with anything? Am I supposed to know whether the K-1 came from a partnership, LLC, S Corporation, Estate or Trust? We will discuss the main parameters of reporting information sent to your client on a K-1 – how much of it do you use? Where do you report it?

Intermediate

2 Hours Federal Tax Law

Session 22: Decedents Final 1040 and 1041, Beanna Whitlock

During this intermediate, two-hour federal tax law session, tax professionals will be exposed by case study to the requirements of filing final form 1040 and when the estate will begin with the requirements of filing. Practitioners will also learn about distributable net income and allocations for the beneficiaries of estates.

Intermediate

2 Hours Federal Tax Law

Session 23: Schedule E – Doesn’t Stand for Easy – Rental Real Estate and Vacation Homes, George Van Buren

Many taxpayers own second houses or apartments that they rent out all the time. Others own vacation homes they rent out when their family isn’t using it. In most cases all rental income must be reported on the taxpayer’s tax return, but there are differences in the expenses taxpayers are allowed to deduct and the way the rental activity is reported on the tax return. This seminar will cover the the following: (1) the rental-for-profit activity in which there is no personal use of the property; (2) depreciation as it applies to rental real estate; (3) the reporting of rental income and deductions including casualties and thefts; (4) special rental situations including cooperatives, property changed to rental use, renting only part of the taxpayer’s property, and a not-for-profit rental activity; and (5) the rules for rental income and expenses when there is also personal use of the property, such as a vacation home.

Intermediate

2 Hours Federal Tax Law

Wednesday, June 13, 2018

Session 24: 2018 Tax Cuts & Jobs Act, Beanna Whitlock

During this four-hour federal tax law update session, the presenter will review the Tax Cuts and Jobs Act (ICJA), the largest piece of passing tax legislation in recent history. Individuals, businesses, and foreign issues-- the presenter will review and do a comparison of provisions to inform tax professionals of the changes.

General to Advanced

4 Hours Federal Tax Law Update

Session 25: Tax Experts Panel, All Presenters

This is a special question and answer session with our unique panel of Tax Experts that includes all our terrific speakers who have agreed to let us test their tax knowledge! Do you have a burning question that is driving you crazy because you cannot find the answer on your own? Did you learn something in one of your classes that needs further explanation for you to understand the tax concept? Questions will only be taken from the floor if time permits.

Intermediate

2 Hours Federal Tax Law

Session 26: Ethics: Where Do You Keep Your Ethics, Beanna Whitlock

During this two-hour, ethics hours session, the presenter will review the rules of ethical conduct for tax professionals and will use Treasury Department Circular No. 230 as a guide. Attendees will also be given scenarios and examples as evidence that even the most ethical of tax preparers can be compromised.

2 Hours Ethics

About the Presenters

Frank R. Acuña

Frank R. Acuña is a founding partner of Acuña Regli, LLP, located in Pleasant Hill, California, with a satellite office in Fairfield, California. Mr. Acuña is certified by the State Bar of California as an estate planning, probate, and trust administration specialist. His practice is built around the needs of tax professionals and includes estate planning, probate and trust law, business succession planning, and inheritance litigation. He is a member of CSTC and is a former CSEA Booster of the Year.

LG Brooks, BA, EA, CTRS

LG Brooks in an Enrolled Agent and is the Senior Consultant of The Tax Practice, Inc., located in Dallas, Texas. LG has been in the field of taxation for more than 25 years and has been in practice full time since 1990. LG’s areas of practice include Tax Representation and Pre-Tax Court Litigation Support Services. LG continues to provide tax presentations for numerous tax and accounting societies and has made presentations at several Internal Revenue Service (IRS) Annual Tax Forums.

LG received a Bachelor of Arts degree from Bishop College at Dallas, Texas in 1977 and is a Fellow of the National Tax Practice Institute (NTPI) and is currently a faculty member of NTPI. He is extremely proud and honored to be an Enrolled Agent.

Ruth H. Godfrey, EA

Ruth has been an Enrolled Agent since 1984 and is President of Godfrey and Hardy Tax & Business Services Inc. She works with both individuals and businesses in her tax practice. Prior to becoming an Enrolled Agent Ruth was a licensed real estate agent specializing in 1031 exchanges. She has many clients involved in real estate and she also has kept in contact with the real estate market even though no longer a licensee.

Ruth conducts seminars and workshops on a variety of subjects for tax preparers, tax payers, and other business professionals. She is frequently offering consultation to other tax preparers as well as to real estate professionals on the proper structuring and reporting of real estate transactions.

Ruth is a past president of CSTC and the Inland Empire CSTC Chapter as well as a Past-Chairman of the California Tax Education Council (CTEC). She is currently serving CSTC as Parliamentarian. Ruth is a Fellow of the National Tax Practice Institute of NAEA and is the NSA District Governor for District X. Involved in civic groups as well as professional; Ruth has also served as president of the Ontario, California Chamber of Commerce.

Forrest Knorr, Special Agent

Forrest Knorr is a Special Agent/Senior Analyst for the Refund and Cybercrimes unit of the IRS Criminal Investigation Division. He has held this position since January 2016. Previously, Forrest served as the Director of Criminal Investigation's International Field Operations. He also was the Assistant Special Agent in Charge for the CI Chicago Field Office and a Supervisory Special Agent for the CI International Group in the New York Field Office.

Eugene Ostermiller, EA

Eugene Ostermiller, EA, has been doing taxes for twenty years, the first nine at H&R Block and then with a partnership he formed with Kathy Stephenson, EA and Grenn Nemhauser, EA called Tax-Matters that is located on Market Street in San Francisco.

Eugene has taught the entire individual classes offered at H&R Block and has been a favorite speaker for CSTC for many years.

Claudia Stanley, CPA, EA

Practicing CPA & EA in the Fresno area, owner of C. Stanley, CPA & Associates since 1991. Graduate of California State University, Fresno. Serves on the boards of the Fresno Chapter of Society of California Accountants and American Business Women’s Association and is currently the President of the State Society of California Accountants. Long time member of the Central California Chapter of Enrolled Agents and California Society of Tax Consultants. Named one of 2001 Top Ten Women of the Year by American Business Women’s Association. From time to time speaks on various tax topics.

George Van Buren, EA

George Van Buren, Enrolled Agent and NTPI Fellow, has a tax practice in San Pedro, California where he has been in business since 1998. His practice serves a diverse client base including individuals, partnerships, and corporations. George also received a BS in Business Administration from the University of Redlands and an MBA from Pepperdine University. In addition to working for a number of years as a Director of Finance for a major aerospace corporation, he has also taught graduate accounting and finance courses at the University of Redlands, University of Phoenix, and the University of California at Irvine.

George has been a seminar speaker for Thomson Reuters Gear for the past 10 years. Additionally, he has given seminars at CSEA Super Seminars and at the local chapters of California Society of Enrolled Agents and the California Society of Tax Consultants.

He is an active member of the California Society of Tax Consultants, National Association of Enrolled Agents, California Society of Enrolled Agents, and the National Society of Accountants.

Beanna J. Whitlock EA, CSA

Beanna is an Enrolled Agent in private practice as Whitlock Tax Service, LLC located in Canyon Lake, TX.

A tax law instructor for more than 35 years with emphasis on Limited Liability Company and Ethics and Professional Conduct presentations. Beanna has taught tax professionals across the country and is an adjunct professor for Auburn University. She is a faculty member of the National Center for Professional Education as well as the Executive Director of the ncpe fellowship, a web-based organization providing educational resources and practice management tools at www.ncpefellowship.com.

She has testified before Congress, the Treasury Department, and the IRS Oversight Board. She has served on the IRS Information Reporting Program Advisory Council as well as the IRS Commissioner’s Advisory Committee. She served as the IRS Director of National Public Liaison for Commissioner Mark Everson and is recipient of the Commissioner’s Award for Excellence of Service.

She has been honored by Accounting Today as one of the 100 Most Influential in Accounting for an unprecedented 7 years.

Known for her fierce defense of the tax professional community, Beanna is frequently consulted by accounting and tax publications regarding issues concerning the tax professional community.

She is the 2013 Member of the Year of the California Society of Tax Consultants.

Honored by the National Conference of CPA Practitioners in 2015 for her contribution to Excellence in Education, “Beanna serves the tax professional community as an inspired calling.”

She is joined in the practice of Whitlock Tax Services, LLC, offering taxpayer representation and tax return preparation by her husband of 50 years, Tom Whitlock. They enjoy antiquing, travel and time at home with their three dachshunds, Bess, Walter, and Buddy, the blonde doxie!

The Symposium presentations have been designed to meet the requirements of the Return Preparer Office, the California State Board of Accountancy; and the California Tax Education Council including code 31 of Federal Regulations10.6 (g). This does not constitute an endorsement by these groups. A listing of additional requirements to renew tax preparer registration may be obtained by contacting CTEC at P.O. Box 2890, Sacramento, CA. 95812- 2890, or phone CTEC at (877) 850-2832, or on the Internet at www.ctec.org.

|