Running Start 2019

North County San Diego Chapter

Date/Time:

Saturday January 5, 2019

Registration at 7:30 AM

Seminar 8:00 AM to 4:50 PM

Location:

California Center for the Arts

340 N Escondido Blvd

Escondido, CA 92025

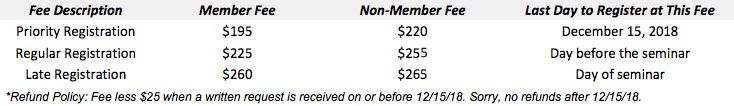

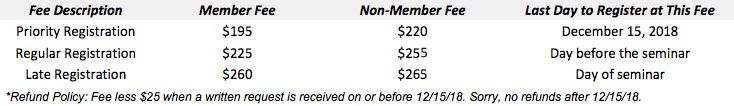

Cost:

Description:

A comprehensive 1-day tax update for 2018 tax returns

•Overview of new tax laws •Complete coverage of new IRS and CA forms

•Real-life examples of how to complete new forms

•199A 20% business income deduction - examples for sole proprietors, S-corps & partnerships

•CA adjustments calculated and illustrated on 540 Sch CA

•Limitations on mortgage interest deductions

•Learn how to quickly and easily reconstruct acquisition/equity debt

•Line-by-line calculations on new IRS forms & worksheets

•Find out why many entertainment expenses are still deductible

•Determine which sales of business or rental property qualify for 199A deduction

•Case studies - client documents to completed tax return

Presenter: Lisa Ihm, EA and Karen Joyner, EA

Lisa Ihm became an Enrolled Agent in 1986 and has been teaching seminars nationwide since that time, including teaching the Running Start seminar for CSTC in recent years. Rather than simply reciting the rules, she digs below the surface to make you think about how tax laws affect your clients and how you can use those laws to your clients' benefits. She works and lives in Coronado, CA and can be reached by e-mail at [email protected] or through her website at www.BrassTax.com •Karen Joyner, EA started preparing taxes in 1988, opening her own practice in 1993, and earning her Enrolled Agents license in May 1995. She is active in local chapters of many professional organizations, including having served as President of the San Diego East County Chapter of CSTC, chairperson for CSTC fall workshops and Running Start, and CSTC society chair for Summer Symposium for several years. She also served as director and on the education committee for the CSEA San Diego chapter. She enjoys the challenge of representing clients before the IRS, Franchise Tax Board, and CTFA (California Department of Tax and Fee Administration) with their collection or audit needs. Karen practices in Coronado, California.

Lisa Ihm became an Enrolled Agent in 1986 and has been teaching seminars nationwide since that time, including teaching the Running Start seminar for CSTC in recent years. Rather than simply reciting the rules, she digs below the surface to make you think about how tax laws affect your clients and how you can use those laws to your clients' benefits. She works and lives in Coronado, CA and can be reached by e-mail at [email protected] or through her website at www.BrassTax.com •Karen Joyner, EA started preparing taxes in 1988, opening her own practice in 1993, and earning her Enrolled Agents license in May 1995. She is active in local chapters of many professional organizations, including having served as President of the San Diego East County Chapter of CSTC, chairperson for CSTC fall workshops and Running Start, and CSTC society chair for Summer Symposium for several years. She also served as director and on the education committee for the CSEA San Diego chapter. She enjoys the challenge of representing clients before the IRS, Franchise Tax Board, and CTFA (California Department of Tax and Fee Administration) with their collection or audit needs. Karen practices in Coronado, California.

Karen Joyner, EA started preparing taxes in 1988, opening her own practice in 1993, and earning her Enrolled Agent license in May 1995. She is active in local chapters of many professional organizations, including serving as President of the San Diego East County Chapter of CSTC, chairperson for CSTC fall workshops and Running Start, and CSTC society chair for Summer Symposium for several years. She has served as director and on education committee for the CSEA San Diego chapter.

Karen Joyner, EA started preparing taxes in 1988, opening her own practice in 1993, and earning her Enrolled Agent license in May 1995. She is active in local chapters of many professional organizations, including serving as President of the San Diego East County Chapter of CSTC, chairperson for CSTC fall workshops and Running Start, and CSTC society chair for Summer Symposium for several years. She has served as director and on education committee for the CSEA San Diego chapter.

CPE Information:

6 Hours Federal Update

2 Hours California

IRS: 18QC1-U-01090-18-I

CTEC: 1000-CE-4468

Knowledge level: Update

Registration:

To register for this event, you must click here to fill out the registration form. You will then email or mail your registration form to:

1925 Palomar Oaks Way, Ste 107

Carlsbad, CA 92008

Fax (760)438-4501

Refund Policy:

Refund Policy: Fee less $25 when a written request is received on or before 12/15/18.

No refunds after 12/15/18.

This presentation has been designed to meet the requirements of the Return Preparer Office, the California State Board of Accountancy; and the California Tax Education Council including code 31 of Federal Regulations10.6 (g). This does not constitute an endorsement by these groups. A listing of additional requirements to renew tax preparer registration may be obtained by contacting CTEC at P.O. Box 2890, Sacramento, CA. 95812- 2890, or phone CTEC at (877) 850-2832, or on the Internet at www.ctec.org.

Prev Month

Prev Month View Month

View Month Search

Search Go to Month

Go to Month Next Month

Next Month

Lisa Ihm became an Enrolled Agent in 1986 and has been teaching seminars nationwide since that time, including teaching the Running Start seminar for CSTC in recent years. Rather than simply reciting the rules, she digs below the surface to make you think about how tax laws affect your clients and how you can use those laws to your clients' benefits. She works and lives in Coronado, CA and can be reached by e-mail at

Lisa Ihm became an Enrolled Agent in 1986 and has been teaching seminars nationwide since that time, including teaching the Running Start seminar for CSTC in recent years. Rather than simply reciting the rules, she digs below the surface to make you think about how tax laws affect your clients and how you can use those laws to your clients' benefits. She works and lives in Coronado, CA and can be reached by e-mail at  Karen Joyner, EA started preparing taxes in 1988, opening her own practice in 1993, and earning her Enrolled Agent license in May 1995. She is active in local chapters of many professional organizations, including serving as President of the San Diego East County Chapter of CSTC, chairperson for CSTC fall workshops and Running Start, and CSTC society chair for Summer Symposium for several years. She has served as director and on education committee for the CSEA San Diego chapter.

Karen Joyner, EA started preparing taxes in 1988, opening her own practice in 1993, and earning her Enrolled Agent license in May 1995. She is active in local chapters of many professional organizations, including serving as President of the San Diego East County Chapter of CSTC, chairperson for CSTC fall workshops and Running Start, and CSTC society chair for Summer Symposium for several years. She has served as director and on education committee for the CSEA San Diego chapter.  Export Event

Export Event